Very Cheap Car Insurance with No Deposit

There is no such thing as free car insurance, but you may qualify for very cheap car insurance with no deposit required if you are tight on cash. Several insurers offer policies with no-deposit, in addition to low monthly payments.

You should also know that not all states allow these no deposit types of coverage. This article will go in-depth on how to get the cheapest auto insurance with no deposit and how to qualify for it. It is easier than ever to get a cheaper auto insurance policy, along with a low down payment. You can use this site to help you find insurers offering:

- $0 Deposit Plans

- Low Deposit Auto Insurance Plans Starting At $20

- Cheapest Rates From Just $37 a Month

- 24/7 Customer Support

What is Cheap Auto Insurance with No Deposit?

The term “no deposit auto insurance” is not a typical type of policy offered by insurers, and many companies do not provide it. It merely refers to a policy that has cheap premiums, in addition to no deposit requirements. The truth is most insurers require a downpayment to begin coverage.

The deposit amount you will be required to pay depends on many factors, including the car you drive, your record, age, and location. The less of a risk you as a driver pose to an insurance company, the more likely you will qualify for instant car insurance with no deposit and low monthly rates.

If you are a high-risk motorist, you could be required to pay 30% or more of the premium amount upfront. If you are a low-risk driver with excellent credit, you could qualify for very cheap auto insurance with no upfront payment and low monthly payments under $100 per month.

Compare no deposit plans from multiple insurers with an online quote. To start, enter your zip code and fill-out an application. It only takes about four to five minutes to complete.

Why are No Deposit Policies Popular?

For most people, there are times their finances get really tight. Consequently, cutting back on spending on unnecessary items like going out to eat or shopping at the mall. However, there are things like auto insurance that are mandatory expenses most people budget for. Some people need new car insurance but have almost no funds to pay for the down payment and require the cheapest installment plans available.

The good news is that they can often find no deposit car insurance or as low as $20 down payment car insurance for those low on cash. It allows someone to get legally insured without tying up a lot of their money. This is the main reason why these types of policies are so popular. Low-income households can get insured without many out-of-pocket expenses.

Let’s go into this subject further and see the pros and cons of auto insurance with no deposit. Enter your zip code to compare the best available rates.

How No Deposit Car Insurance Works

When you are buying car insurance, you are provided with different payment options. You may pay the total premium amount upfront or make monthly installment payments. Most people prefer to make installment payments and opt for the cheapest deposit possible.

No deposit auto insurance works this way. Once you make your first installment payment, the insurer will consider that amount to be your deposit. So, you are not getting free car insurance, but the good news is you don’t have to pay a big deposit amount upfront. Once you make your first monthly payment, this will be considered the deposit.

This plan helps people get insured quickly without tying up a lot of their money. These types of policies have grown in popularity in recent years, and nothing down plans remain a popular choice for many drivers.

Who is Eligible for No Down Payment Auto Insurance?

Different insurance companies have different deposit requirement amounts for certain drivers. It’s important to note that not every driver will qualify for very cheap car insurance with no deposit or low-cost coverage altogether. To better your chances of getting this type of deal, you should have:

- A clean driving record with no tickets

- No DUIs on your record

- A Credit Score of 700 or higher

- Drive a vehicle that has low insurance rates (stay away from exotic cars)

- Be Over the age of 25

- Continuous Coverage for three or more years

Where can you get Cheap No Deposit Car Insurance?

The reality is that no deposit auto insurance is only available in several states. Each state sets its own insurance regulations and laws. The states that do allow it are:

- California

- Washington

- Florida

- Arizona

- Georgia

- New York

- Oklahoma

California is the most populous state and has dozens of insurers. If you live in California, you can compare zero down auto insurance plans from multiple providers. To get started, just enter your zip code.

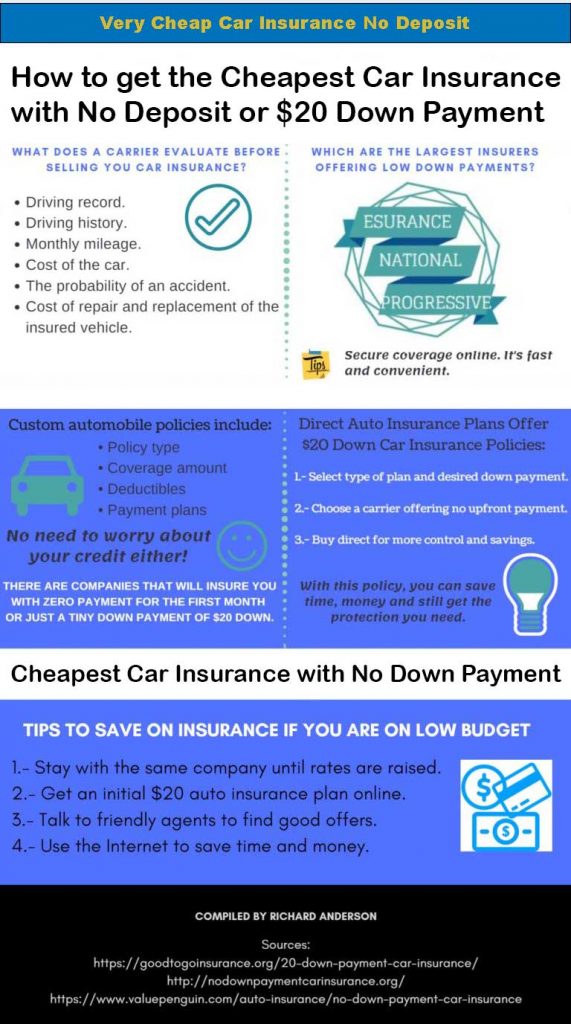

What Companies Offer Cheap Coverage with Nothing Down?

Several carriers have great deals on cheap auto insurance coverage with no deposit. A few of the providers are:

- State Farm

- Kemper

- Safe Auto

- Progressive

- Esurance

- USAA

- Farm Bureau

- Auto-Owners

- American Family

- Nationwide

- Allstate

- Travelers

- Farmers

Your best bet is often going with a direct provider like Progressive Insurance or Esurance. They usually have some of the lowest deposit requirements and rates for basic liability coverage that starts near $30 per month.

Available Payment Options

Most carriers offer several ways to pay for your premium. This includes:

- Yearly

- Every Six Months

- Quarterly

- Monthly

As stated before, if you cannot afford to pay the full premium cost, you can always opt for installment payments. You can lower your down payment costs even more by qualifying for no deposit car insurance, but you must meet certain conditions and live in one of the states that offer this type of coverage.

No Down Payment – Monthly Payments vs. 12 Month Plan – Full Payment

| Cost Difference | No Deposit Plan | Paid in Full |

|---|---|---|

| 1st Payment | $129 | $1,470 |

| Monthly Payments | $1,419 | $0 |

| Amount Saved | $0 | $78 |

Some insurers even offer small discounts if you set-up automatic monthly installment payments using your debit or credit card. This discount is given because when automatic payments are in place, the insurers get paid more often and on a set date. This reduces the rate of late payments from customers.

If you decide to pay for the entire premium in one lump payment, you can save about 2% off the premium’s total cost. You also don’t have to worry about making another insurance payment for an entire year, which is another benefit of paying in full.

No Deposit Policies for Seniors

Seniors are some of the safest drivers of any group. They also drive less often. This is why they are afforded some of the best rates and discounts. This includes low deposits and even no down payment auto insurance for senior drivers. Several companies, including The Hartford and State Farm, offer special rates for qualifying seniors between the ages of 55 and 70. To get a quote and compare online rates, start by entering your zip code.

No Deposit Car Insurance Plans for Young Drivers

Because this group of motorists, between the ages of 16 and 25, are some of the riskiest drivers on the road, they pay higher rates for auto insurance than any other group of drivers.

Most teenagers, for example, pay double what a 35-year-old married driver pays for the same coverage. In recent years, accidents involving young drivers have surged, which can be largely attributed to distracted driving. This includes the use of cellphones while driving and even texting behind the wheel. In almost every case, very cheap auto insurance with nothing down is not a real option for drivers under 25 years of age.

Pros of No Deposit Car Insurance

The more significant benefit of cheap car insurance no deposit plans is for people low on cash. Those drivers low on funds can get insured right away without tying up a lot of their money with a big deposit. For example, let’s say someone just used up the majority of their savings buying a new SUV and has almost no money left in the bank that month for car insurance. In this case, a no deposit auto insurance plan would allow the driver to get insurance now pay later. They would just need to make the first monthly installment payment, and their coverage would start right away.

Cons of No Deposit Auto Insurance

The main drawback of this type of policy is paying a higher rate. The less of a deposit amount you put down at the beginning of the policy, the more the insurer is taking on financial risk. Many insurers require a deposit of 20% or more of the overall premium. Companies that offer no deposit auto insurance will charge higher rates for this increased risk. This is the main drawback of this type of policy.

Affordable Coverage with a Low Deposit

A good affordable insurance plan with a low deposit allows you to keep more cash in your wallet. This kind of coverage is perfect for people on a limited budget and can’t afford to tie up their funds with a significant deposit.

Some insurers don’t offer no deposit plans but offer affordable down payments that start at $20. In states where no down payment policies aren’t provided, this is your best bet. In some areas like the “Peach State,” you can qualify for cheap auto insurance with a low deposit in GA.

To get the lowest deposit where you live, you need to have a low-risk profile. The next step is shopping around the best rates and the lowest deposit required. Online quotes can help you compare 10 or more rates in only a few minutes. You can even use your smartphone to compare cheap car insurance with no down payment options.

If you find a better rate while your current policy is active, you can cancel it and get reimbursed if you have an outstanding balance. You should shop about every six months for lower rates for the coverage you need.

Advantages of very Cheap Car Insurance no Deposit

- You’re able to get covered right away with legal auto insurance with no money out of pocket

- Be eligible for cheap installment payment plans starting at $29 per month

- Keep more of your money for other expenses

Is No Deposit Auto Insurance a Good Fit for You?

The answer to this highly depends on your financial situation. If you are really low on funds and need to get insured right away, then you will need to focus on very cheap car insurance with no deposit. In this case, it makes sense. Once you make your first installment payment, your policy will become active, and you will be legally insured. Then you just need to make monthly installment payments until your policy expires.

On the other hand, these policies are more expensive. If you have the money available, you can save by paying the entire premium amount in one payment. Compare low deposit rates in about five minutes. Enter your zip code and get started with a quick quote.

Auto Insurance Pricing Factors

There are so many factors that go into how insurers calculate rates. Each company has its own formula. Some of the main factors that will determine the rates you pay in addition to the deposit amounts are:

- Age of the Driver

- Driving Experience

- Vehicle Driven

- ZIP code

- Credit Score

- Driving Record

- Homeowner or Renter

- Marital Status

How to Get Cheaper Auto Insurance Rates with a Zero Down Policy

Getting cheap auto insurance with no deposit means being less of a risk in the eyes of insurers. If you are a good driver over 25 with no tickets and drive a safe vehicle, like an SUV, you will get cheaper rates. Also, opt for a higher deductible of $1,000 or more. This can reduce your premiums by 15% or more. You can also lower your insurance costs to bundle all your vehicles together and your home onto one policy. This can save you 10% or more.

Get all the discounts you can. This includes discounts for:

- Safe Drivers

- Military Service

- Multi-Car Discounts

- Bundling Auto and Homeowners into one policy

- Teacher and Union Discounts

- Defensive Driving Course Discount

- Senior Citizen Discounts

- Safety Feature discounts (front and side airbags and antilock brakes)

You can also qualify for additional discounts that can save you even more. This includes:

- Garaging your vehicle at night

- Installing GPS Based Safety Features

- Setting up recurring automatic payments

Every discount will add up and help you get the lowest rate possible.

Only Get the Coverage you Need and Cancel Overlapping Coverage

There is a good chance you already have rental car protection with your credit card agreement. If you have an AAA membership, you will already be covered for towing and roadside assistance. If you have these, then don’t add them to your auto insurance policy. This way, you will save you only 2% to 3%, but it all adds up.

You want to focus on the coverage you need and not have any unnecessary coverage that only inflates your premiums. Getting the cheapest car insurance with no deposit upfront requires you to go over your policy carefully, eliminate overlapping coverage, and look at all the ways you can save money.

What to Look for in a Company that Offers No Down Payment Coverage

So, you have compared several quotes from insurers that offer no deposit auto insurance plans. You should consider more than what provider has the cheapest rate. Each year, many insurers go out of business and others with poor reviews for claim payouts and customer service. Make sure any company you are considering buying a policy from has:

A solid financial footing:

Check A.M. Best for the insurer’s overall financial health. Make sure the provider you are thinking of buying a policy from has at least an A overall rating.

Fast and Accurate Claim Payouts:

Nothing makes customers angrier than paying their premium for several years, only to file a claim and have a slow payout. Or, even worse, an insurer that refuses to pay a claim when there is clear evidence they should.

Check with the Better Business Bureau:

Go to sites like the Better Business Bureau or the Rip Off Report to check on a company’s reputation. Make sure they pay claims on time and in full. Many smaller companies that offer cheap auto insurance with no down payment do so to entice new customers but have bad reputations in making fair and timely claim payouts. Do your due diligence before you buy any policy from a new company or one that has many customer complaints.

Good Customer Service:

You want an actual live company representative that will assist you with any problem you have. For claim filing, you will want to look for a company that offers 24/7 support, so you can start your claim immediately.

Multiple Payment Options:

Make sure your insurer offers automatic monthly payments and allows you to pay for your policy online.

Good Website:

Most people pay their bills in today’s world and make changes to their accounts online without ever calling an agent or representative. Make sure a potential carrier has a good website that allows you to get a free quote, upgrade your coverage, pay your bill, and file a claim all online.

How to Get Very Cheap Car Insurance with No Deposit

Getting the cheapest rate and lowest deposit possible requires you to meet specific standards. In short, you must be a low-risk driver to qualify for special discounts, like no down payment.

You will need to meet certain requirements. This includes:

- Need to be 25 Years of Age and Older

- Have a Clean Driving Record with no Accidents and Tickets

- A Good Credit Score of 700 or higher

- Continuous coverage (Ideally 5 years or longer)

- Drive a Vehicle that is Cheap to Repair or Replaces

- Get Basic Coverage. ( A Comprehensive Coverage Policy will result in a higher down payment )

An insurer will also look at other factors when deciding your down payment amount and overall premium. This includes the area where you live and how many miles you drive each month. If you live in a high-crime area with higher auto theft rates, accidents, and insurance fraud, you will pay more for coverage.

Premiums and deposit amounts will also depend on how many people you decide to put on the policy. If you put a teenage driver onto your policy, you might end up paying a large deposit, as much as 33% of the annual premium, in addition to larger monthly installment payments.

Another tip is to read all the fine print before you buy a policy from any company. Many smaller companies try to sell cheap no deposit car insurance plans to get you to buy a policy, only to charge much higher monthly rates and increase the premium significantly once the policy expires. As always, take your time and do thorough research before you buy any auto insurance policy.

Shop Online to Find the Cheapest Auto Insurance With No Deposit

The best place by far to find very cheap car insurance with no deposit is online. Using sites like this one allows you to search hundreds of carriers, both national and regional, and compare their lowest rates and minimum deposit requirements.

Many direct providers have some of the best rates available. Many consumers report saving $500 or more by buying a direct policy online. To compare the rates where you live, just enter your zip code and fill out a quick quote. It only takes about five minutes, and you can compare up to 10 quotes. Get started now and find the coverage you need at low rates you can afford.