Cheap Usage Based Car Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

In recent years, a new type of auto insurance has gained popularity based on the mileage a person drives and their driving behavior. It is known as usage-based coverage. Although it is not an entirely new option, it has become more popular as people have reduced driving, especially in urban areas. Insurers have always used the number of miles driven to factor policy rates, but some new companies have significant discounts available if you drive under a set amount each month. Let’s look at how to get cheap usage based car insurance, and then you can decide if it is right for you. Get your free quote online from Good to Go Auto Insurance right away.

In simple terms, usage-based automobile insurance determines how often you use your vehicle. If your car is only driven on the weekends or in summer, your rates will reflect this low use. Some people, especially those with high net worth, have several cars in storage that are rarely used. Getting a policy that offers discounts for low-use driving is essential in this case.

Usage-based vehicle insurance is cheaper because the automobile insured is not exposed as much to traffic conditions and, thus, in theory, will get into far fewer accidents. Insurance pricing, after all, is based on the risk each person projects. The area you live in and the number of miles the car drives are two huge rate factors. If someone lives in a high-crime neighborhood and drives more than 1,000 miles monthly, their rates would be much higher.

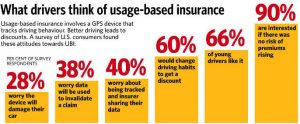

In recent years, companies like Progressive Insurance have introduced data technology that plugs right into a person’s vehicle. Using telematics, companies can get an accurate reading of someone’s driving behavior, where they travel, and how many miles they put on the odometer. This has taken the guesswork out of determining risk.

Before the vehicle industry introduced this new innovative telematics-based technology, many people would not exactly tell the truth about where they lived or the actual mileage they drove. Insurers actively promote this new option, but many people find it an invasion of their privacy and “big brother” watching their every move. If you don’t mind having your activity behind the wheel analyzed, and you don’t use your car much, then you should seriously consider checking it out.

You are considered high risk if you’re a hard driver who takes off fast, brakes very hard, and takes curves to the limit. On-board applications can analyze how you drive and whether or not you are a safe, low-risk motorist. Some devices even allow audible alerts to motorists that drive incorrectly or too fast. Insurance companies will review your driving data periodically and adjust your rates up or down depending on how much risk you pose. Insurers also use many factors to calculate pricing, like the time of day you use the vehicle most and the cities the car is driven in. However, one of the most significant factors in getting cheap usage-based car insurance will always be the miles driven each month.

Some insurance carriers now offer coverage that is based on the miles driven. The more you drive, the higher your rates will go up, and conversely, the less you are on the road, the cheaper your premiums will be. The price an individual pays depends on numerous factors like a person’s age, driving record, car model, and so on. If you rarely drive your automobile, less than 10,000 annual miles, you should look into this specialty coverage type. It is possible to save hundreds per year, so it is worth spending your time getting a free quote. Get cheap usage-based auto insurance with Good 2 Go today.

To get cheap usage based car insurance, make sure you cut down on your monthly mileage and drive carefully. The data does not lie. If you follow these two tips, you can lower your premiums quite a bit. Get a free usage-based quote from good to go insurance today. Compare plans and rates from all the leading providers. Get started now and get a better car insurance deal online.