Auto Insurance Premiums

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

When you purchase an automobile insurance policy, the premium is the amount you pay for the coverage you get. If your annual cost for your Ford Van is $1,325, then your auto insurance premiums could be paid in full or set up on a monthly payment plan. Many insurers offer discounts if you pay the amount in full because they invest this money and make a capital return off the funds.

For those on a tight budget, it helps to spread out the cost of insuring your vehicle over 12 equal payments. Nearly all online insurers have flexible payment plans that allow you many options to choose from. As more insurance carriers go online with their policy payments, customers can pay online and even set up auto-pay plans that will be conveniently withdrawal the premium amounts due on a payment schedule.

Many factors go into how much you pay for insurance. The one thing that is constant is that you must carry coverage if you operate a vehicle. State insurance departments set forth the minimum insurance guidelines that residents must abide it. The state mandates require certain basic levels of coverage, and the cost of your premiums will be based on this in part.

How do Automobile Insurance Premiums get Calculated?

Your auto insurance premiums are calculated using a complex algorithm of numerous factors, which point towards risk. Some of the factors include small things like whether your car is parked in a garage or not if you are married and your zip code area. Here a few of the main factors that will determine the premium cost you pay for insurance.

1. Your age and sex.

Young drivers under the age of 25, in general, pay much higher costs than older drivers. Women, although the debate has raged on for decades, pay less for policies because they get in far fewer accidents.

2. Your Automobile

The more expensive your vehicle is, the higher the replacement or repair costs are going to be. This is why car insurance premiums cost more for newer and more expensive vehicles. Let’s illustrate this. A new $50,000 Mercedes is going to cost a lot more to repair after a serious accident than an old $2,500 pick-up truck. Insurers have to charge more for expensive vehicles to cover these huge costs.

3. Your Driving History

Not only do tickets cost money, but they also drive up the cost of insurance. If someone has serious driving violations like operating a vehicle while intoxicated, (DUI) or racing at a high rate of speed, premiums costs can jump by 50% or more. Keep your driving safe and watch your rates go down.

4. Your Credit

Insurers are placing more emphasis in recent years on a person’s personal credit score when calculating rates. Many good drivers who have had financial challenges think this is totally unfair. However, the trend looks like it is here to stay. The best way to get cheaper coverage is to keep your credit rating high.

5. The Coverage You Want

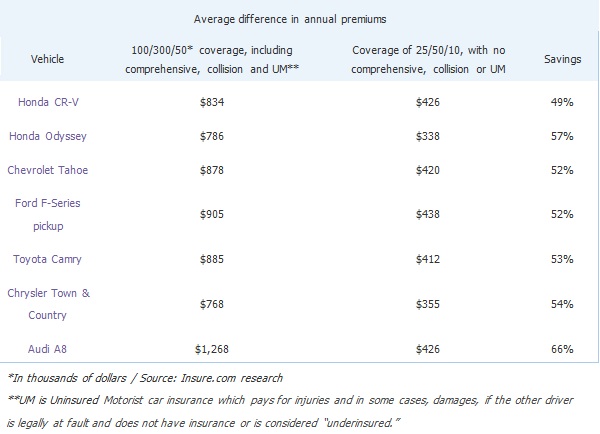

The more coverage you get, like collision or comprehensive added onto your policy, the higher your premium costs will be. The advantage of getting high coverage limits is you simply are protected more. If you get into a serious accident, you most likely will need expensive medical care and your vehicle replaced. Major accidents can result in costs reaching hundreds of thousands of dollars, so it is highly recommended to get the best coverage you can afford.

Getting a higher deductible can lower your insurance Premiums

A simple way to get your insurance bill down and still have a great policy is to raise your deductible. A deductible of $1,000 or higher can lower your premiums by 10% or more. These savings should allow you to carry better coverage at a lower rate. Just keep in mind that if you go to a higher deductible plan, make sure you set aside the amount in the event you do get into a crash. If you file a claim and don’t have the deductible amount to pay, your insurer could cancel your coverage.

What Happens if you do not pay your Insurance, Bill?

Not paying your car insurance bill could get your coverage canceled. This would cause a lapse, and your future insurance costs will go up. Even worse, if you get caught driving uninsured, you could get your automobile towed and face enormous fines. Some insurers have grace periods, but be safe and get your auto insurance premiums paid each billing cycle on time, so you stay covered. Get a free good to go quote now and compare rates online.