$20 Down Payment Car Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

If you are low on cash and need to cover your vehicle right away, a $20 down payment car insurance can help you out. Many people on a tight budget in today’s economy need the cheapest deposit possible when buying insurance coverage. Drivers who meet certain criteria might pay a cheap down payment car insurance, as low as $20. It’s important to note this is not a type of policy but rather the down payment required to activate an insurance policy.

It seems the cost of almost everything is going up these days, and car insurance is no different. Finding affordable goods and services like auto insurance can be a considerable challenge. Buying auto insurance with the lowest deposit and monthly payments can help those who otherwise could not afford coverage get insured with minimal upfront costs. Almost anyone can afford to get legally covered with a $20 down payment car insurance plan. To compare rates and plans where you live, enter your zip code and fill out a quote application.

Most insurers will demand that you pay part of the premium upfront before a policy becomes active. The problem is some cash-strapped people can’t afford $100 or even a smaller $50 down payment. For many, in today’s stressful economy, paying for a new auto insurance policy can seem out of reach. This includes students and those recently laid off from work or who lost their job.

Many people put a large down payment on a vehicle, and they need car insurance now pay later with the lowest deposits. Also, certain conditions, like someone who used up all their savings to move into a new rental home or apartment, can leave them with little funds left over for insurance coverage.

Some insurers offer $20 down payment car insurance for select drivers. It’s important to note not all motorists will qualify for this type of discounted policy, and there are restrictions. Get a quote and compare rates from multiple providers to find what carriers offer a $20 deposit car insurance policy. To get started, enter your zip code.

This is a problem that far too many people face when buying or leasing new vehicles. The good news is that some options with down payments start at only $20. Several insurers like Progressive will waive the down payment on a full coverage policy and let your first premium installment payment be credited as the deposit.

For example, let’s say your full coverage policy costs $1,800 per year, and the deposit amount is 10% or $180. With some carriers, you can make the first month’s payment of $180 and the subsequent 11 months’ payments of $147. This helps out those short on cash who can’t make both a deposit and a first-month car insurance payment, all within the first month.

If you shop around for these deals, it’s possible to find cheap car insurance with no down payment and rates under $100 per month. Compare at least ten quotes from both national and regional providers. Check our top list of car insurance companies.

Getting the cheapest down payment, as low as $20, depends in large part on a person’s risk profile. The less of a risk a driver is, the lower they will pay for the deposit and overall premium cost. High-risk motorists will likely not qualify for $20 down auto insurance. This includes drivers with multiple points on their record, several at-fault accidents, or even DUIs. Insurance providers will assess your risk and determine if you qualify for very cheap car insurance with no deposit or policies that require a low deposit.

You will likely be asked for your social security number when filling out a quote. This will play a significant role in risk assessment and the rates you will end up paying. If you have a low credit score under 650, you probably will not qualify for $20 down auto insurance, even if you have a clean driving record.

It’s also important to note that new vehicles, especially those that cost more than $35,000, will require a larger deposit. New leased vehicles almost always require comprehensive coverage, which requires a larger upfront deposit. Those drivers who require an SR-22 or have had reckless driving tickets or DUI convictions in the past will be required to pay a more considerable amount of the total premium upfront.

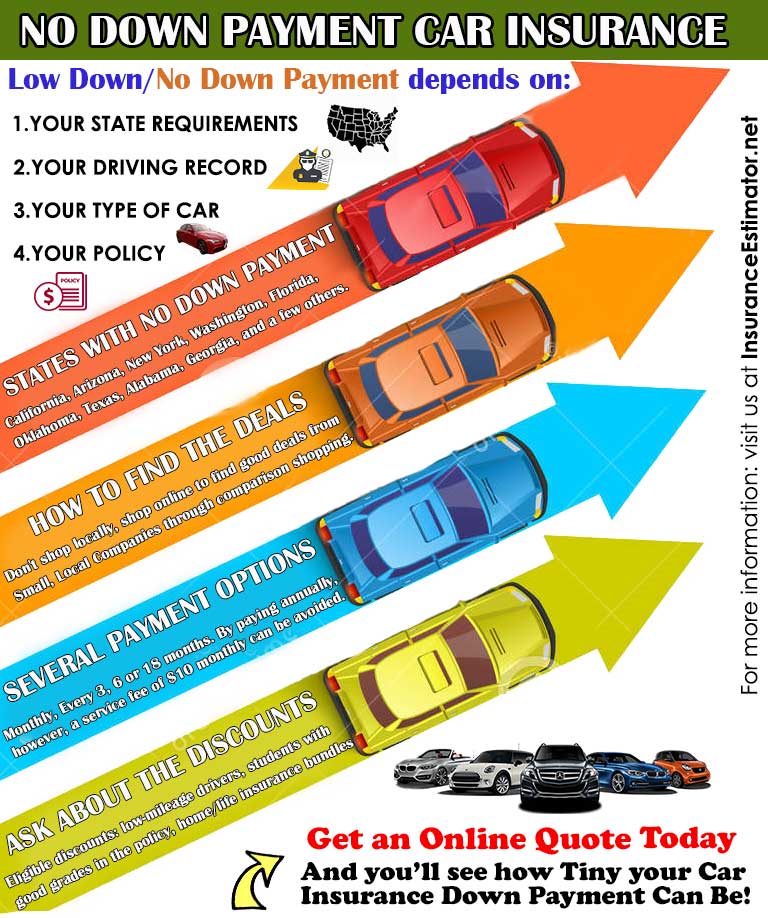

Only certain states allow insurers to offer $20 down and zero down car insurance. These include:

Not many insurers offer this type of deeply discounted policy, and it’s not heavily promoted. Most insurers require deposit amounts of 20% or more of the total premium. Several insurers offer $20 down payment car insurance deals to qualifying drivers. It’s smart to get quoted by all carriers offering cheap down payment car insurance plans.

Companies that offer cheap low-deposit car insurance coverage include:

If you can’t pay the full premium amount upfront, you can take advantage of installment programs. These are usually monthly payment plans offered before you buy a policy. You can always pay for your policy in full if you have the funds. Most providers offer a 2% discount for paying the policy upfront. The payment terms are set up with several options for you to choose from. This includes:

When a person decides to pay for their coverage through an installment plan, they usually need to put down a deposit before the policy becomes effective. Typically, the first month’s payment is what most insurers require.

With a $20 down payment car insurance plan, you can often get insured for the first month under $100 with a “bare bones” liability-only policy. To illustrate this better, let’s say you opted for liability-only coverage for a used 2013 Hyundai Sonata. Your twelve-month premium might be $850, with a required $20 deposit to activate the policy. So, your first month’s payment will be $90.83. This includes the first installment payment of $70.83 and the $20 deposit.

Many people incorrectly think all they need to pay for the first month’s coverage is the deposit amount. This is simply not true. You will be required to make the first installment payment as well as the deposit before your coverage kicks in.

There are several ways you can pay your insurance bill. One of the benefits of getting a direct policy is you can make your payment online. Here are a few of the most common payment methods:

If you set up automatic payments, you can qualify for a small discount that will save you more.

When you buy auto insurance coverage, the provider is taking a risk and betting that you won’t get into a wreck. This includes calculating many factors of risk, like repair and replacement costs.

If you have a new BMW that costs $60,000, you probably won’t qualify for $20 down payment car insurance. However, if you own a used Toyota Corolla that you only drive about 600 miles per month, there’s a higher chance you will qualify for the lowest deposit car insurance.

The less likely you are to get into an accident, the more willing an insurer will be to offer incentives on the policy, including a low upfront deposit.

Another factor that comes into play is credit rating. These days auto insurance firms are placing more weight on a person’s credit score. The theory goes that someone responsible for their money should also be a safe driver and less likely to get into a wreck.

To qualify for a $20 down auto insurance policy, you need to make sure your credit rating is in good standing. If it is not, take aggressive steps to get it fixed as soon as possible. Having a good credit score above 700 will not only help you get $20 down payment car insurance but so many other things like a low-interest rate auto loan.

You’ll have a much greater chance of getting a $20 down payment car insurance if you get a liability-only policy. You can purchase the state minimum coverage for as little as $29 per month. It depends on factors like the state you live in and your overall risk profile.

Liability insurance is mandatory in every state. It’s the minimum amount of coverage you must buy to be legally covered. It’s also a starting point for insuring your car, as it comes with limited coverage that won’t fully protect you in a severe accident. These “bare bones” policies can cause more harm than good if you get into a major wreck.

The reality is most insurers require an initial down payment before a policy goes into effect. There is no such thing as a free auto insurance policy. If you live in a state that allows a $20 down payment car insurance, you can get insured for the first month with minimal out-of-pocket cost to you.

Carriers won’t take the risk of insuring someone without first receiving a payment upfront. So many consumers are attracted to the idea of getting a free first-month car insurance policy. The reality is there’s no free car insurance available from any insurer.

Insurance companies want long-term clients who can afford to stay covered. Prospective customers who want something for free are often not good long-term clients. They are more prone to cancel their policy, not make a payment, or, even worse, file a false claim.

Therefore, you’ll not likely find low-cost car insurance with no down payment. However, it’s wise to search for the cheapest policy available in your area.

For many people with a new or newer vehicle leased or financed, buying full coverage car insurance is required. This means getting covered with a comprehensive plan that will protect the vehicle’s value from almost any incident.

While this is enhanced protection, it comes with higher premiums. Full coverage protection can easily cost more than double what a basic liability policy costs. For many people that can barely afford a new vehicle, this puts them in a tough situation. The lending company forces them to buy a comprehensive policy but might not even have enough money for the car insurance down payment.

Securing a $20 down payment car insurance for comprehensive coverage helps those low on cash who need more excellent protection. Compare full coverage quotes online in about five minutes. Enter your zip code to get started.

You must consider that these low-down policies are often more expensive than paying the total premium upfront and in full. For example, you might be getting a great deal on a policy that requires nothing down or a deposit of just $20. These policies often cost 5% to 10% more than if you paid a higher upfront deposit. However, for those drivers short on cash who need immediate coverage, it can really help out.

If you are able to find low-cost insurance with a $20 down payment or first-month free car insurance, you need to know you will probably end up paying more than if you made a significant down payment. This is one disadvantage of this type of policy.

However, many people who don’t have any savings need the lowest deposit policy possible. Getting a $20 down payment auto insurance coverage can help someone who otherwise could not get insured.

The truth is very low deposit policies and $20 down payment car insurance can cost 10% more than a typical policy that requires a 25% upfront deposit. Some mistakenly associate a low-deposit auto insurance plan with a cheap policy. Even if your deposit is as low as $20, your monthly payment could be $150 or more. If you put down more money upfront, say $175, that installment payment could be around $130 monthly. In most cases, the larger the deposit amount you pay, the lower your monthly payments will be.

If you have the money, it’s also smart to pay the entire premium amount in full. This decision can save you some serious money. It also reduces stress because you won’t have to worry about making recurring payments each month.

Drivers under the age of 25 often have unique problems. Many don’t have a lot of money, yet they are charged more for things like auto insurance and loans. This is because statistics show younger motorists get into more accidents than any other age group. They also take more risks and have bad habits. They often, you guessed it, text and talk on the phone while driving. So, how does a young driver get very cheap car insurance with no down payment or a very low $20 deposit? The odds are stacked against them, but it’s still worth a try.

First, compare several plans from direct insurers like Progressive and Esurance. These large insurers often have more flexible plans, with deposits that might be as low as $20 but often are $50 or more.

The next step is to get a basic policy, such as state minimum liability coverage. This minimum coverage will reduce the overall cost of the premium. As a rule of thumb, the lower your total cost of coverage, the lower your deposit will be.

So, for a 6-month liability insurance plan that costs $370, you might only need to put down a deposit payment of $45. This is one way to get low deposit auto insurance coverage. You also want to have a vehicle that is cheaper to insure. A new Corvette, for example, will require a larger deposit than a 10-year-old Ford Focus. If you want the lowest down payment auto insurance, get a used, older car with a four-cylinder engine and four doors.

Drivers over 55 are some of the safest motorists on the road. Their years of fast, reckless driving are long behind them. Statistics prove that seniors between 55 and 65 are some of the safest drivers, who get into far fewer wrecks than younger motorists. They rarely twitter or text while driving. Many seniors qualify for $20 down payment car insurance because they do not drive as much.

Many older motorists drive less than 800 miles per month. Insurers also love these drivers because they tend to pay their bills on time and stick with one company for years. Many seniors can qualify for $20 down payment car insurance in select areas for these reasons. Older drivers over 55 can be eligible for some of the lowest deposit amounts of any group of drivers. Compare quotes now by entering your zip code.

If you need the cheapest car insurance with a low deposit starting at $20, start your search online no matter where you live. You can compare prices from national and regional insurers in just a few minutes. This way, you will let you see who has the lowest available rate without a down payment for the coverage you need. There are things you can control to get cheaper rates.

These include:

Getting cheap auto insurance with a low down payment will be easier in some areas. For example, you might qualify $20 down payment car insurance in Florida if you:

Multiple auto insurance discounts can help you save hundreds per year. This includes:

Finding cheap $20 deposit auto insurance is a difficult task. Look for insurers that have low deposit options, like Progressive and Esurance. If your risk profile is good and you have a used vehicle, you might qualify for a $20 down payment car insurance. The more risk you pose to an insurer, the higher your deposit amount will be.

Also, the more expensive your automobile is, the more of a down payment you will be required to pay upfront. Get started now by entering your zip code and comparing the best rates from top-rated insurers. Apply for quotes online to find the best rates and lowest deposit requirements. This will save you time and help you find a $20 down payment car insurance plan more easily.