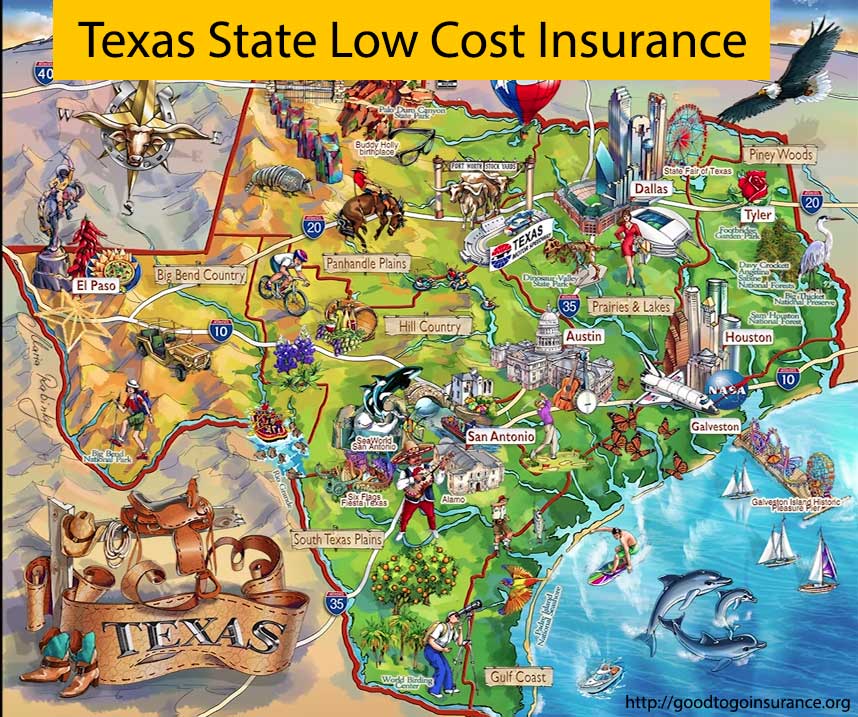

Texas State Low Cost Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

If you’re a proud resident of Texas, you are legally required to have auto insurance if you operate a motor vehicle. From Houston to Austin and everywhere in between, coverage is necessary. If you need the cheapest possible rates, check out Texas state low cost insurance. You don’t need to go broke getting your car or truck covered.

Rates start as low as $20 per month for qualified drivers. Apply now for a free, no-obligation Texas state low-cost insurance quote. Start by entering your zip code.

State law requires that Texas drivers pay for damages if they cause an auto accident. It means securing minimum Texas liability insurance in the least. Liability is coverage that pays to fix or replace the no-fault driver’s vehicle. It can also pay medical expenses if that driver was injured during the accident.

Remember that liability coverage only pays for accidents in which you were at fault, and the coverage itself is limited. In most cases, to protect yourself financially, you should look into getting collision or comprehensive coverage.

All drivers licensed in Texas must hold liability insurance covering bodily injury and property damage. They must have, at the least, the following limits:

There are a few optional coverage choices available in the state of Texas. While the law does not require them, they are worth considering to give you better protection and peace of mind. These include:

Auto insurance can vary greatly depending on how much coverage you purchase, what company you go through, and what kind of car you have, among other factors. Texas state low cost insurance rates average about $1,330 per year.

The average costs differ depending on multiple factors, and each insurer weighs the overall factors uniquely. For example, the average cost of insurance in Dallas for men is $1,329 per year, while it costs $1,383 for female drivers. People in Dallas pay much more for the same coverage than drivers in the rest of Texas. Overall, annual state average insurance costs are $934, below the national average.

The national average is $889, making the Texas state’s car insurance costs 5% cheaper. Premiums in Texas have been steadily increasing over the past few years. This phenomenon can be attributed to increased population, higher claim costs, and more stolen vehicles.

Your Texas rates may vary depending on your current driving record, credit history, how many claims you have filed, and the zip code where you reside.

By law, it is required that Texas auto insurance rates are fair and not at all discriminatory. They also cannot be too excessive. People of all income levels and situations should afford the most essential Texas liability auto insurance coverage.

Most insurance companies in Texas use their rates, then file them with TDI, the Texas Department of Insurance. TDI can then ask insurance companies to refund the money to policyholders if they deem the policy unfair or the rates too high.

TDI Address: 333 Guadalupe, Austin, Texas 78701

Phone: 800-252-3439

Underwriting is the process insurance companies use to determine whether they can sell insurance to you and how much they should charge. They consider many different factors in assessing premiums.

All underwriting guidelines have to be approved by TDI. The factors most commonly used to determine rates include: These factors will, for the most part, set your premiums.

Many discounts will help you get Texas state low cost insurance. While each insurance company has different ones, you can often qualify for several. These include:

You’ll get a proof of Texas auto insurance card when you buy your Texas state low cost insurance policy. You need to keep this card in your vehicle at all times. This is because you may be asked to show it when:

Your Texas state low cost insurance can cover various factors depending on which kind of coverage you have. For example, Texas state low cost insurance in Temple, TX, or Austin, Texas, can typically pay for the repair or replacement of your vehicle and medical expenses you may suffer during an accident. Other costs include towing, rental car expenses, court fees, and more.

You should know about special exclusions, so you aren’t unaware when something isn’t covered. As well as what’s included you should pay special attention to what is not included in your policy. Common exclusions include:

A review of the different types of insurance policies available in Texas and what they cover can help you better understand what kind of plan would work best for you. Here is a breakdown of the insurance types you can consider buying:

This type of insurance policy meets the state’s requirements in its most basic form.

It pays for the following expenses:

Who it covers:

Depending on your policy to be covered when you drive someone else’s car. You are not covered for a company car, though. Speak with your agent about what kinds of vehicles are and aren’t covered by Texas liability only insurance. Some policies may not even cover others who live with you, not even family members. It’s essential to declare the names of those you want to be covered by your policy. As previously stated, liability car insurance is the cheapest but provides “bare bones” coverage. If you are in a severe accident, it likely won’t pay for the medical costs and vehicular damage that results.

It is the type of insurance that covers damage done to your property. If you owe money on your car, you need to have collision coverage. Also, if you lease a vehicle, you will need to get it.

What it pays for:

Who it covers:

Comprehensive will be required if you lease a vehicle. It is another type of insurance policy that does not include collision coverage. Your lender may require you to have it if you want to get a loan for the money you owe on your car.

What it pays for:

It is the correct type of policy to have if you are ever seriously injured in an auto accident.

What it pays for:

Who it covers:

Many states require PIP as part of your insurance policy. If you suffer from lost income or wages due to an accident, it’s essential.

What it pays for:

Who it covers:

Most insurance policies do include PIP automatically. However, you can choose to opt out of it in writing. Companies are legally obligated to offer up to $2,500 in PIP coverage.

This is an excellent policy if you suffer an accident at the hands of someone without auto insurance. It can save you financially and is not that expensive to add to your existing policy.

What it pays for:

You do have a $250 deductible for property damage with this policy. While you have to pay this initial $250 for your damage, the insurance company will pay the rest.

What it pays for:

What it pays for:

Parents can add their children to their Texas state low cost insurance plan as long as they meet their financial responsibility requirements set out by the state of Texas. This can bring down a lot of the cost of insuring a young driver under 25. While younger drivers can add a costly expense to the bill, it is still overall cheaper than putting them on a different plan.

Some auto insurance policies require that all drivers are named on the policy. If you are unsure whether or not you need to call all drivers, contact your insurance company immediately and confirm all of the drivers that should be on the policy.

If a teenager mainly drives one of your vehicles, their rate will be based on the car type. You can expect the teenager’s rate to be the highest in the household due to the teen being a high-risk driver.

Putting a teen driver in a certified driver’s education course is wise to save money. It can help lower Texas car insurance rates by 10% or more. Also, make sure the young motorist has an old, cheap car. Stay away from sports cars and newer vehicles that can be more than 50% more costly to insure.

All insurance companies will try to determine whether you are worth the risk before renewing your auto insurance policy. They will look for driving records, claims filed, credit reports, etc.

If you have an accident or a claim on file, it can significantly increase your premiums’ cost. If you have recently been convicted of a DUI, your insurer may cancel your policy, and it could be challenging to find a Texas insurer that offers you future coverage.

You may see some added surcharges on your plan if you’re deemed a high-risk driver. You can be charged much more for coverage if you have any of these violations:

Most surcharges remain on your policy for three years. An insurance company may also decide to cancel or end your policy before its renewal date. Some companies like Good to Go Insurance can help you get cheap Texas high-risk coverage. Apply online for a free quote and compare cheap side-by-side rates.

If you have an auto-renewal policy, your insurance company may not decide to let you cancel it. If it has been in effect for over two months, they will not cancel it unless you can give one of the following reasons:

If you or the company cancels your Texas state low cost insurance policy, they will refund your unearned premiums. This amount will correspond to the money you paid in advance but was never used during coverage. It will go into effect the day after cancellation.

By law, insurance companies cannot refuse to renew your policy unless it has been in effect for over a year. If you have a 6-month policy, they must give you 12 months. Additionally, companies must provide notice at least 30 days in advance if they refuse to renew your policy.

Any insurance company in Texas cannot refuse your policy based on the following:

If you do receive a non-renewal notice, your best bet is to start searching for a new insurance policy immediately. Suffering from a gap in auto insurance coverage can cause your premiums to go way up the next time you purchase insurance.

It would be best to shop around for Texas state low cost insurance. Rates vary quite a bit with each insurer, so you must get multiple quotes. Here are a few extra tips:

Between comparing quotes and finding appropriate discounts, you can decide on a Texas state low cost insurance policy that works best for you without breaking the bank. Get a free quote and compare rates in about five minutes. Get the cheapest low cost Texas auto insurance you need and save more.