Car Insurance for Convertibles

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

What’s the whole point of buying a car if it’s not exciting to drive? That’s usually the attitude and mindset of owners of convertibles. They just don’t want a sporty and fast car; they want to feel all the elements hit them as they blaze down the road. After all, there’s nothing more thrilling than flying down a sharply curved roadway. With the wind in your face, all the while hearing the tires screech and the engine roar. This is the reason why you buy these types of cars in the first place. So are these types of automobiles more expensive or cheaper to insure? Let’s examine car insurance for convertibles and go into some tips on how you can get insured for less. Get direct quotes in four minutes or less with good to go auto insurance online.

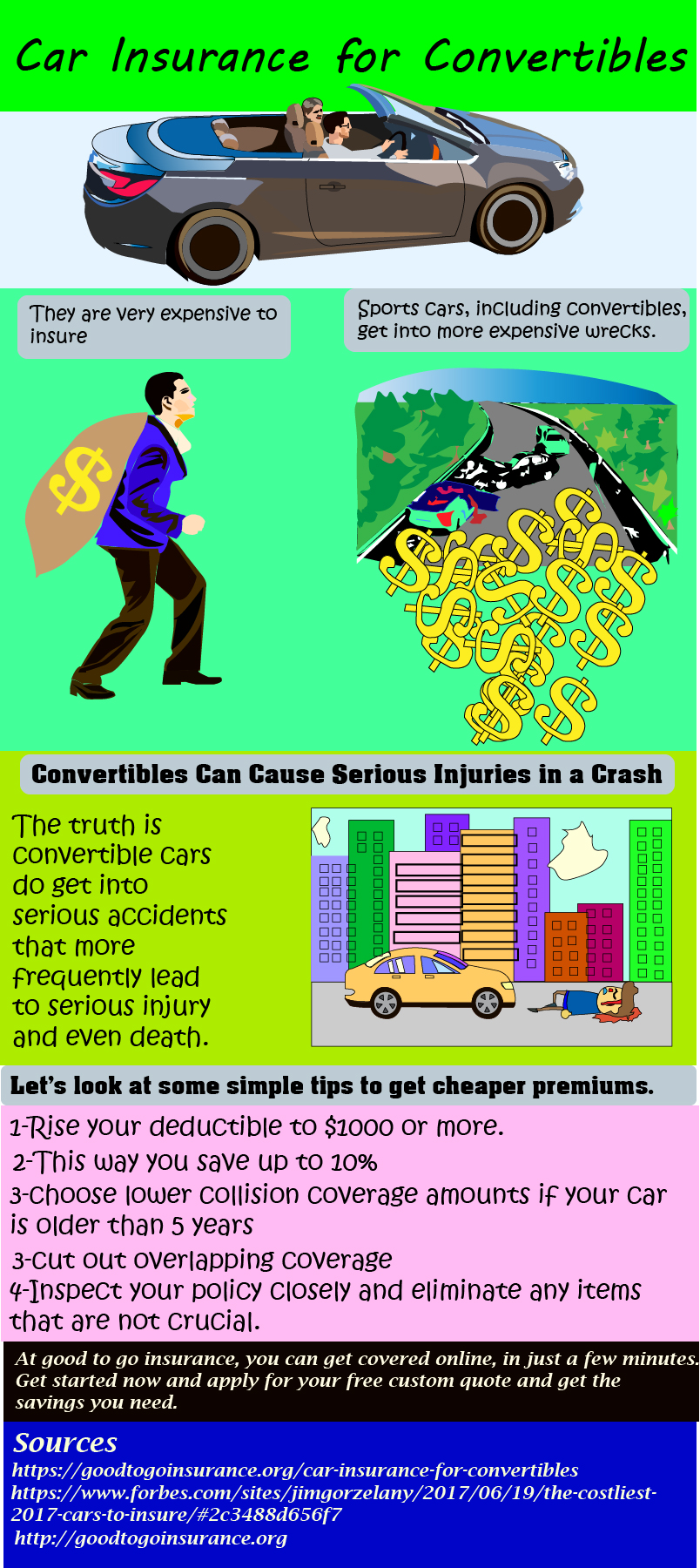

One of the biggest factors carriers use to calculate the premiums you will pay is the car you drive. In general, sporty vehicles that go fast will cost more to get insured. Let’s use some common sense here. People don’t buy a Porsche or Corvette to drive like old ladies parallel parking in a church parking lot. Insurers know that these high-performance vehicles will be driven hard, and many drivers will go fast and make risky driving maneuvers. You might ask how they can possibly know this. The answers are in the data. Carriers compile massive amounts of accident data and claim payout costs for each make and type of vehicle. Sports cars, including convertibles, get into more expensive wrecks.

The truth is that convertible cars get into serious accidents that more frequently lead to severe injury and even death. These automobiles also are more expensive to repair. Without a top to protect the riders, the vehicle occupants are exposed to significant damages in a severe crash. It includes rollover injuries and side-impact accidents that can be deadly. Even when the top is in use, it is almost always a softer, weaker material exposed to high impact crashes. All of this results in companies charging more to insurer convertibles.

For drivers under 25, rates can be 200% or more than those of a regular Sedan driven by a middle-aged driver. While it may seem unfair to label all young drivers as risky, carriers need to charge more to stay in business. It’s not very often you see a teenager driving a sporty convertible, probably because the insurance rates are just too high. Usually, you see middle age or older men and women driving these types of cars.

Now that we know it will be more expensive insuring most convertibles let’s look at some simple tips to get cheaper premiums. The first thing you are going to want to do is raising your deductible. Raise it as high as you can, to $1,000 or more. This will save you about 10% on your insurance bill right away. Just make sure to set aside the full amount of the deductible in case you need to file a claim.

The next thing you want to do is choose lower collision coverage amounts but only do this if the car is more than five years old. If it is new, you want to stay with higher limits. Also, you need to cut out overlapping coverage. This includes towing, roadside assistance, and rental car insurance. Most people don’t even realize that their credit card plans already cover them for rental car incidents. Inspect your policy closely and eliminate any items that are not crucial. This process will only take you a few minutes and could save you another 5% off your bill.

The best way to get cheap convertible car insurance is to shop online. This one essential tip can save you 15% or more of your policy cost. You want to compare at least 10 direct auto insurance quotes. When you have a large sample pool, you can be assured you are getting the lowest rates. Many insurers offer cheaper direct rates because they don’t have the huge costs of offices and professional agents. They pass these savings on directly to you. At good to go insurance, you can get covered online in just a few minutes. Get started now and apply for your free custom quote and get the savings you need.