Car Insurance for Convertibles

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

Convertibles offer an exhilarating driving experience, with the wind in your hair and the open road ahead. However, insuring these sporty vehicles can come with higher premiums due to their performance and design. This guide explores why car insurance for convertibles costs more and provides practical tips to secure affordable coverage. Compare quotes at Goodtogoinsurance to find the best rates in minutes.

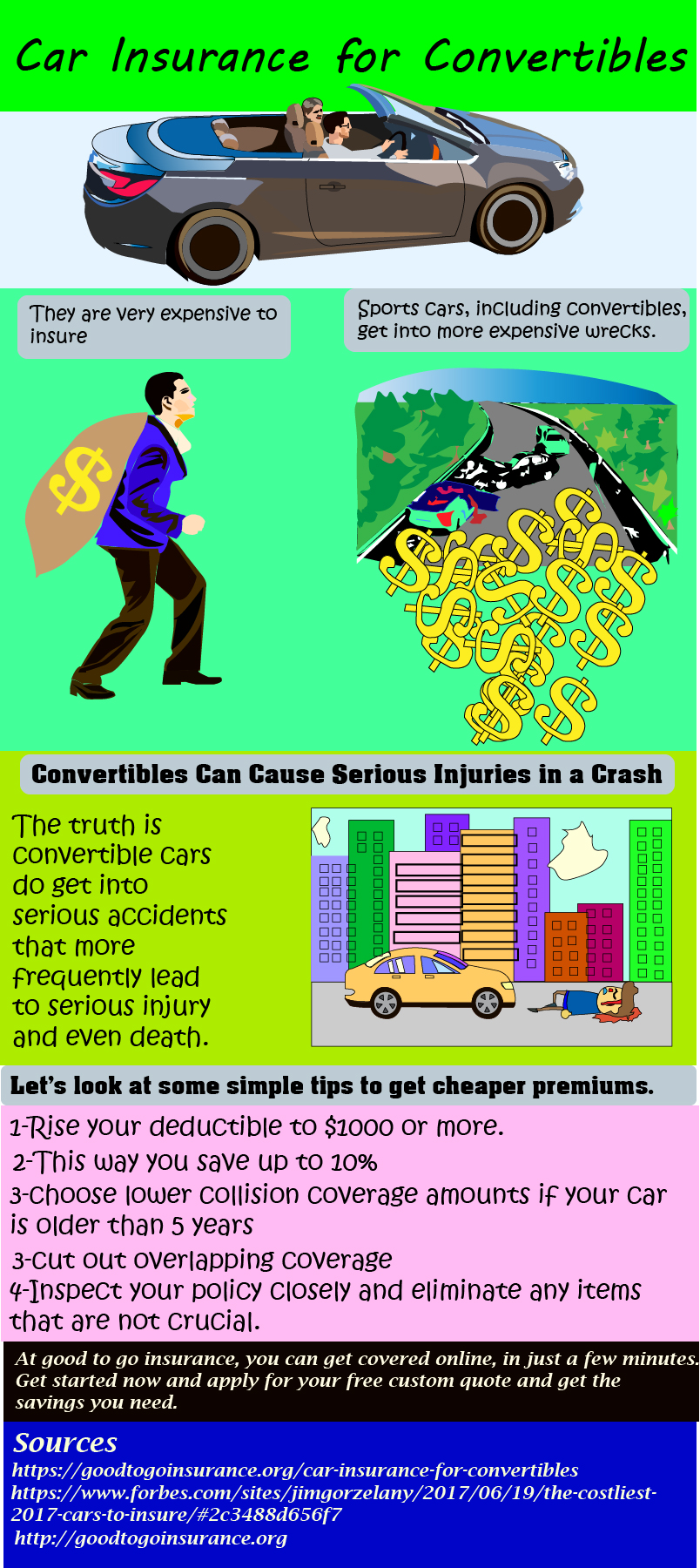

Insurers base premiums on risk, and convertibles pose unique challenges. Their sporty nature and design contribute to higher insurance costs for several reasons:

These factors make convertibles riskier to insure, especially for drivers under 25, who may face premiums up to 200% higher than those for middle-aged drivers with sedans. Explore cheap young driver car insurance for ways to reduce costs.

While convertibles are pricier to insure, you can lower premiums with these strategies:

Buying car insurance online can save you up to 15% compared to traditional agents. Online platforms eliminate overhead costs, passing savings to you. Compare at least ten quotes from national and regional insurers to find the lowest rates. At Goodtogoinsurance, you can get personalized quotes in just four minutes.

Convertible owners should consider additional factors to optimize coverage:

Convertibles cost more to insure due to their high-performance nature, increased risk of severe injuries in crashes, and costly repairs. Insurers factor in accident data and vehicle design, as discussed in auto insurance premiums.

Young drivers under 25 face higher premiums due to increased risk. To save, opt for liability-only policies or safer vehicles. Check young driver insurance options for affordable plans.

Increase your deductible, remove unnecessary coverage, maintain good credit, and compare quotes online. Explore auto insurance discounts for additional savings.

Comprehensive coverage is recommended for convertibles, especially if financed or valued over $20,000, to protect against theft and vandalism. Learn more at car insurance coverage guide.

Some insurers offer no-down-payment car insurance, but convertibles often require higher deposits due to their cost. Compare quotes to find low-deposit options.

Ready to save on convertible insurance? Get started with fast auto insurance quotes at Goodtogoinsurance and find affordable coverage today!