10 Car Insurance Tips

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

Securing affordable car insurance doesn’t mean compromising on coverage. With the right strategies, you can significantly reduce your premiums while maintaining robust protection. Here are 10 practical tips to help you save on auto insurance, from adjusting deductibles to exploring unique policy options.

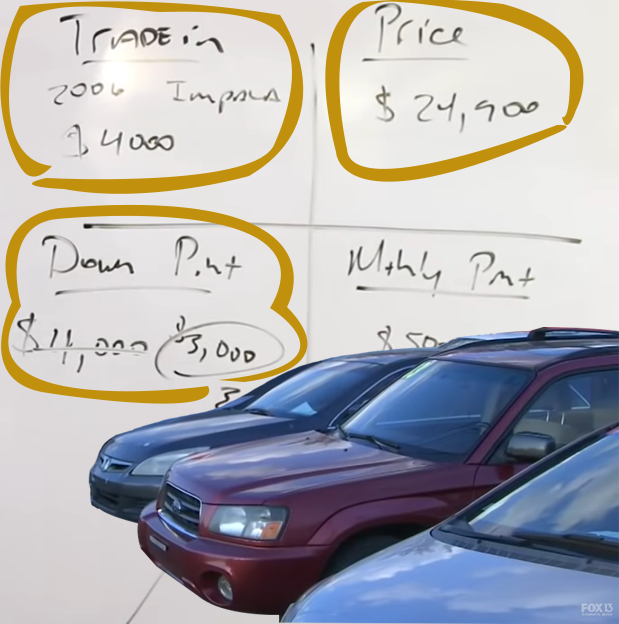

Your deductible is the amount you pay before insurance covers a claim, typically ranging from $100 to $1,000 or more. Raising it to $1,000 can lower premiums by up to 10%. Ensure you have funds reserved for the deductible in case of an accident. Learn about tailoring simple insurance plans to your budget.

Forget spending hours on the phone with agents. Compare insurance quotes online from multiple providers in just 6–7 minutes. Online platforms often offer exclusive rates due to competitive markets, potentially saving you over $500. You can also manage policies, pay bills, or file claims digitally. Get started with online auto insurance.

Homeowners with separate auto and home insurance can save 5–15% by bundling. This not only reduces costs but also simplifies billing with a single provider. Discover how to maximize savings with direct insurance bundles.

If you have two or more cars insured with different providers, you’re likely overpaying. Bundling vehicles under one policy can save up to 10%. For families with teens, adding their car to the main policy can cut costs by 25% compared to standalone coverage. Explore multi-vehicle policy options.

A credit score above 650 can unlock lower insurance rates, as insurers see it as a marker of reliability. If your score is low, improving it can lead to noticeable premium reductions. Understand the impact of credit on insurance quotes.

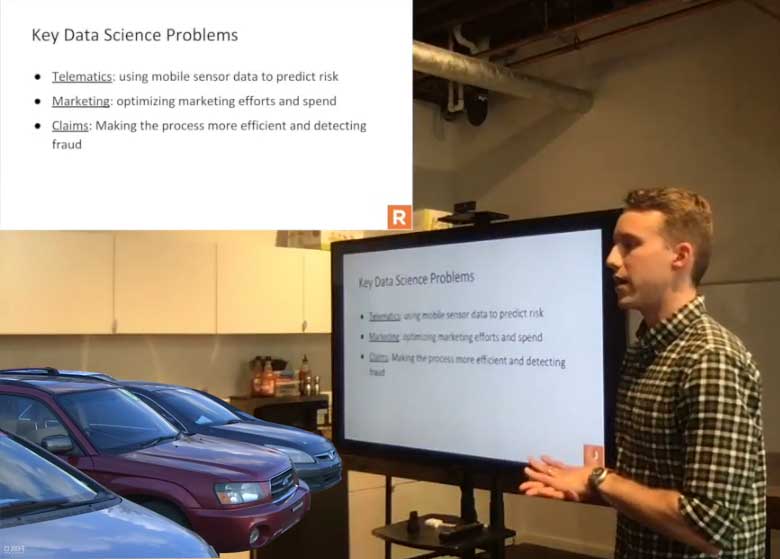

Safe drivers can save 15% or more with telematics programs from insurers like Progressive or Geico. These use apps or devices to track driving habits, rewarding cautious behavior. If you’re open to monitoring, this is a smart way to save. Check out pay-as-you-go insurance for similar benefits.

A clean driving record (no at-fault accidents for several years) can yield a 5–10% discount. Certified safe driving courses, often taught by former highway patrol officers, can further lower rates by enhancing your skills. Learn about safe driving techniques to qualify.

Paying your annual premium in full can save around 2% and eliminates monthly payment hassles. For those needing flexibility, explore month-to-month insurance plans as an alternative.

You may qualify for several discounts, such as:

Find more ways to save with insurance saving strategies.

Even with a 12-month policy, check rates every six months to find better deals. Cancel your current policy if a cheaper option arises. Online comparisons are quick and can save hundreds. Make it a habit with affordable insurance searches.

Increase your deductible, shop online, bundle policies, improve your credit score, and stack discounts like safe driver or telematics rewards.

Telematics track driving habits via apps or devices, offering up to 15% discounts for safe drivers. Explore telematics insurance.

Bundling auto and home insurance typically saves 5–15%, but compare rates to confirm. Check bundling benefits.

Review rates every six months to find savings, even with a yearly policy. Use rate comparison tools.

Yes, a score above 650 often lowers rates. Learn more about credit-based insurance quotes.

Start saving now! Enter your zip code to compare car insurance quotes and apply these tips today!