New Mexico Car Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

New Mexico is often referred to as the land of enchantment. This beautiful area has some of the most scenic routes of any state in the U.S. You get around in N.M. There is just one large city in the state, Albuquerque, with a cluster of smaller towns. One of the main USA freeways, I-40, passes throughout the state. It has staggering views from the flat tundra. To get around in NM, you will need a car and New Mexico Car Insurance. High mountain tops. With all the driving around, it pays to get quality auto insurance to protect your assets and have the peace of mind you need. Get covered today with rates starting at $29 monthly at good to go insurance.

This state has implemented an electronic database system. It monitors the status of a person’s auto insurance for all registered automobiles. When someone applies for car insurance and the policy is bound, the insurer has to report the coverage to the state of NM. If your policy is dropped, you will be notified by the state and aN. Med to show proof of insurance. If there is no compliance and a person continues to drive without being covered, they could have their registration revoked. There could also be fines imposed.

If your auto insurance was suspended for whatever reason, there are a few steps you need to take to reinstate your vehicle registration. This includes first buying valid New Mexico auto insurance. You will need to have your provider update the policy info with the state insurance database to be legally in the system. You should also be aware there is a reinstatement fee that is imposed. This cost is $30. Get covered for less with a low-cost plan from goodtogo insurance online or over the phone. As you can see, it does not pay to go without insurance.

There are certain minimum insurance coverage mandates that motorists must comply with. This includes:

You can petition to get uninsured driver coverage by filling out a signed form available from your insurance provider. However, you may want to think carefully before canceling it. It is estimated that 25% of New Mexico’s drivers carry no auto insurance. It means that if you were to, unfortunately, get into a severe accident, you could be left with a financial burden, which could quickly bankrupt you. Get a cheaper policy with good to go auto insurance today.

There are several steps teens need to take in New Mexico before they are fully licensed. At 15, a teenager’s car applies for a learner’s permit. They can then only drive under the supervision of an adult over 21. At 15 years and six months, if a teen has completed 50 hours or more of supervised driving, they may apply for a provisional license. Finally, after successfully holding a temporary permit for one year, the teen may be issued a standard driver’s license.

Buying the minimum auto insurance will get you legal, but it might not be enough coverage. Here are some optional coverages you can add to your policy.

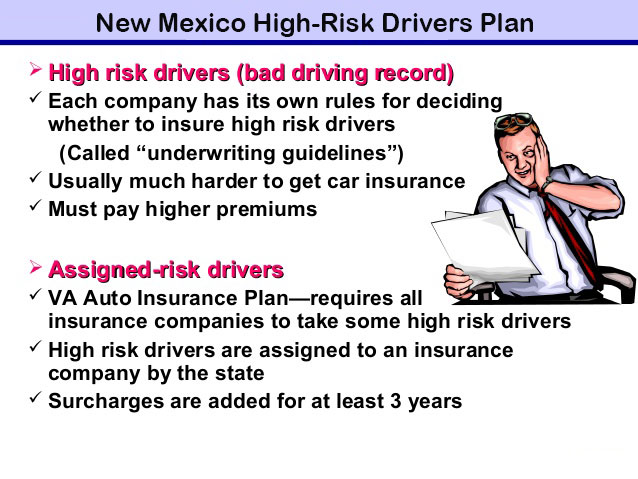

All drivers must carry the minimum auto insurance mandated by the state of New Mexico. Many so-called high-risk motorists, however, find it difficult to get covered. This is often attributed to filing multiple claims or other issues, such as a reckless driving violation or a DUI offense. There is some hope for this group of motorists, however. Officials in the insurance department have instituted the “New Mexico Motor Vehicle Insurance Plan.” This plan starts off the moment other insurers stop providing coverage.

If you feel your auto insurance provider has cheated or misled you, you need to contact this office. It merely fills the car ins needs of high-risk drivers. You can apply online or call 415-765-6767 during regular business hours, Monday through Friday. There is also a helpline with representatives standing by for those consumers who have general questions about getting insured. The Consumer Assistance Bureau accepts questions and complaints. You can reach them at 505-827-4601.

The best and fastest way to get insured is online. Most consumers can save hundreds with direct rates that cut out the intermediary. Online shoppers that need the cheapest New Mexico car insurance can apply for coverage in less than five minutes at Goodtogo online. You can compare multiple plans and rates from the top national carriers. Get started now and see how simple it is to save $500 or more on automobile insurance.