Is Your Auto Insurance Tax Deductible?

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

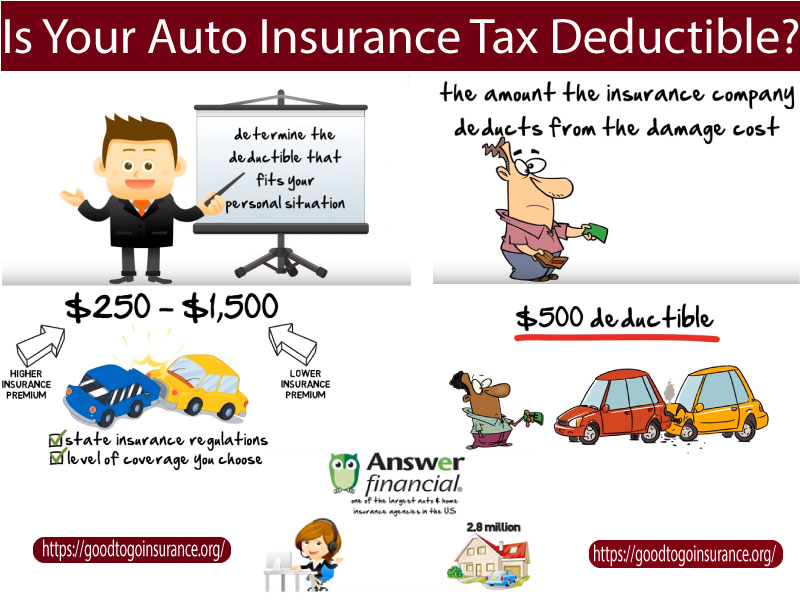

Tax season brings opportunities to maximize deductions, especially for small business owners. One common question is: Is your auto insurance tax deductible? The answer depends on how you use your vehicle. At Good to Go Insurance, we help you save on business auto insurance and understand which expenses can reduce your tax burden.

Auto insurance premiums for personal use, like commuting or running errands, are not tax deductible. However, if you use your vehicle exclusively for business purposes—such as deliveries or client meetings—you can deduct the full cost of your premiums. For mixed use, you can deduct a portion based on the percentage of business use. Learn more about business vehicle deductions to optimize your savings.

If your car is used solely or partially for business, you can deduct various expenses beyond insurance premiums. Common deductible items include:

Non-deductible expenses include traffic tickets, as they’re considered personal penalties. Consider defensive driving courses to keep your record clean and avoid rate increases.

Business owners have two options for deducting vehicle expenses:

Consult a CPA to determine which method maximizes your savings, especially if you’re new to self-employed deductions.

Detailed records are crucial for justifying deductions, particularly if audited by the IRS. Tips for effective record-keeping include:

Proper documentation reduces audit risks and simplifies tax filing. Explore insurance documentation tips for better organization.

Self-employed individuals or first-time filers with business deductions benefit from hiring a CPA. A professional can identify overlooked deductions, ensure compliance, and minimize audit risks. While CPA fees may seem high, they often save money by maximizing deductions and preventing costly errors. For ongoing tax management, use accounting software and maintain organized records daily to streamline the process.

Lower your deductible expenses by securing cost-effective auto insurance. Good to Go Insurance compares up to 10 quotes from top providers in minutes, helping you save hundreds on direct insurance plans. Whether you need liability coverage or a comprehensive policy, our platform ensures you get the best rates without obligation. Print policy details and ID cards online for added convenience.

No, premiums for personal use are not deductible. Only business-use portions qualify. Learn about personal insurance options.

Deduct premiums, gas, repairs, registration, tolls, loan interest, and depreciation for business use. Track expenses with deduction strategies.

Actual expenses may yield higher deductions but require detailed records. The standard mileage rate is simpler. Consult a CPA for tailored advice.

Compare quotes online to find affordable rates. Use Good to Go Insurance for instant quotes starting at $39/month.

Maximize your tax deductions and save on insurance with Good to Go Insurance. Get your free quote today and drive with confidence!