The Basics of Non-Owner Auto Insurance

Non-owner auto insurance provides essential liability coverage for drivers who frequently borrow or rent vehicles but don’t own one. This policy protects you from significant out-of-pocket costs in case of an at-fault accident, covering damages or injuries up to the policy’s limits. Whether you borrow a friend’s car, use car-sharing services, or rent vehicles, non-owner car insurance offers peace of mind and financial protection.

Why Choose Non-Owner Car Insurance?

Driving someone else’s car without proper coverage can leave you liable for costly repairs or medical bills if you cause an accident. Non-owner insurance acts as a secondary layer of protection, supplementing the vehicle owner’s policy. It’s ideal for those who don’t own a car but need to maintain continuous coverage to avoid rate hikes or meet state requirements, such as after a DUI. Get a quick quote in minutes using online insurance tools to compare affordable rates.

What Does Non-Owner Insurance Cover?

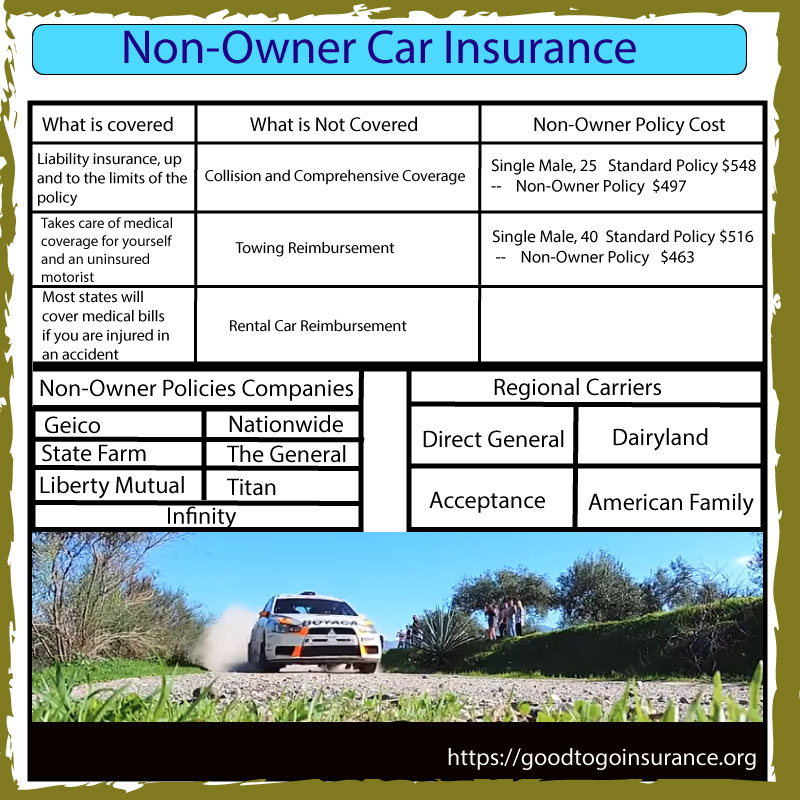

Non-owner auto insurance typically includes:

- Liability Coverage: Covers property damage and bodily injuries you cause in an at-fault accident, up to the policy’s limits.

- Medical Payments or Uninsured Motorist Coverage: May cover your medical bills or injuries caused by an underinsured driver, depending on the state and insurer.

Always review the policy details to understand coverage limits and ensure adequate protection. For more on liability coverage, explore liability insurance options.

What’s Not Covered?

Non-owner policies do not include:

- Collision or comprehensive coverage

- Towing reimbursement

- Rental car reimbursement

For rental cars, consider a collision damage waiver from the rental company to cover vehicle damage.

How Much Does Non-Owner Insurance Cost?

Non-owner policies are generally more affordable than standard car insurance, starting at around $39 per month for drivers with clean records. Costs vary based on factors like age, location, driving history, and frequency of vehicle use. High-risk drivers with violations, such as DUIs, may face higher rates. The table below compares average annual costs for standard and non-owner policies:

| Age | Standard Policy | Non-Owner Policy |

|---|---|---|

| 25 | $548 | $497 |

| 40 | $516 | $463 |

For high-risk drivers, check out insurance options for high-risk drivers to find affordable coverage.

When Should You Get Non-Owner Car Insurance?

Consider non-owner insurance if you:

- Need an SR-22 form to reinstate a license after a DUI or serious violation.

- Frequently rent cars for travel or work, as it’s often cheaper than purchasing rental company insurance.

- Regularly borrow a friend’s or family member’s car, protecting you from liability in at-fault accidents.

- Use car-sharing services like Zipcar, covering costs beyond the service’s liability limits.

- Want to maintain continuous coverage to avoid future rate increases, even without owning a car.

Note: If you live with your parents and drive their car daily, you should be added to their policy instead of purchasing non-owner insurance.

Non-Owner Insurance for Rental Cars

Some insurers extend non-owner coverage to rental cars, which is valuable for frequent travelers. While rental companies provide state-minimum liability insurance, it may not suffice for major accidents. Non-owner policies can offer higher limits, and some cover international rentals for an additional fee. Always compare rates before purchasing, and explore specialized vehicle insurance options for unique needs.

Which Companies Offer Non-Owner Insurance?

Several national and regional insurers provide non-owner policies, including:

- Geico

- State Farm

- Farmers

- Allstate

- Acceptance

- Liberty Mutual

- Nationwide

- The General

- Titan

- Infinity

- Travelers

Regional carriers like Direct General, Dairyland, and American Family also offer non-owner policies in specific areas. Existing policyholders with these companies may qualify for discounts. Compare providers using insurance company lists for the best options.

How to Buy Affordable Non-Owner Car Insurance

Non-owner insurance is less common but easy to purchase online through comparison platforms. Use quick quote tools to compare rates from multiple insurers in about five minutes. This ensures you find the cheapest policy tailored to your needs, offering peace of mind when driving a borrowed or rented vehicle.

Frequently Asked Questions

Who needs non-owner car insurance?

Non-owner insurance is ideal for those who frequently borrow or rent cars, use car-sharing services, need an SR-22, or want to maintain continuous coverage without owning a vehicle.

What does non-owner insurance cover?

It provides liability coverage for property damage and injuries you cause in an at-fault accident, plus limited medical or uninsured motorist coverage, depending on the policy.

How much does non-owner insurance cost?

Costs start at around $39 per month for drivers with clean records, but rates vary based on age, location, and driving history.

Can non-owner insurance cover rental cars?

Yes, some policies extend to rental cars, offering higher liability limits than rental company insurance. Check with your insurer for international coverage options.