First Month Free Car Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

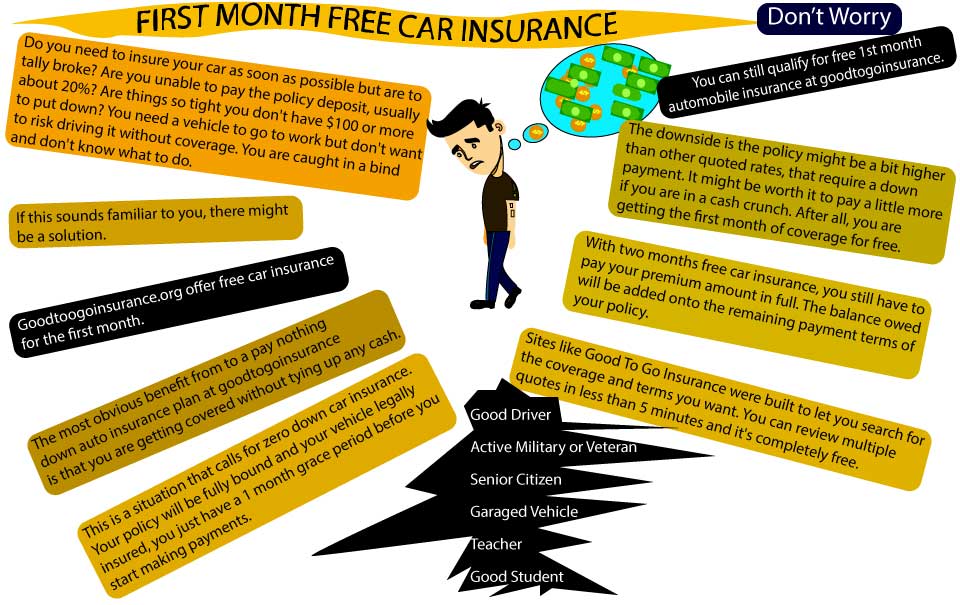

Need affordable auto insurance without breaking the bank? First month free car insurance offers a budget-friendly way to get covered quickly. At Good to Go Insurance, we connect you with trusted providers offering low initial payments, allowing you to spread costs while staying legally insured. Compare car insurance quotes in minutes to find plans tailored to your needs and budget.

First month free car insurance doesn’t mean zero cost. Instead, you pay a small deposit—typically $20–$40—and the first month’s premium is deferred, spreading the balance over the remaining policy term. For example, a $760 annual liability-only policy with a $40 deposit would cost about $65.45 monthly for 11 months, covering the $720 balance. This structure lowers upfront costs while ensuring full coverage, ideal for drivers on tight budgets.

These policies provide key advantages for drivers seeking affordable coverage:

For similar cost-saving options, explore no-down-payment car insurance.

Eligibility for first month free promotions varies, but you’re more likely to qualify if you meet these criteria:

High-risk drivers with DUIs or multiple accidents may face challenges qualifying, though minor infractions might not disqualify you. Check out tips to secure coverage as a high-risk driver.

Beware of insurers advertising “free” or “zero-down” policies. No reputable provider offers coverage without an initial payment, as they’d risk significant losses from unpaid claims. For instance, a $30,000 at-fault claim shortly after policy activation could be financially disastrous for insurers. Choose transparent providers offering affordable car insurance plans to avoid scams.

Some insurers offer two months of coverage with a minimal deposit, typically for loyal customers with a year of continuous coverage or low-risk profiles. This allows you to drive with reduced costs initially, with the premium balance spread over the remaining term. Such deals are uncommon and often limited to specific providers. Use our online insurance application to check eligibility with carriers like Progressive or Kemper.

Maximize your chances of landing this deal with these practical steps:

Comparing quotes through Good to Go Insurance can save you up to $500 annually. Our platform delivers up to 10 quotes from trusted carriers like Progressive, Kemper, and Farmers in just 5 minutes. Simply enter your zip code and complete a quick form to find plans starting at $39/month. Whether you need full coverage or basic liability, we ensure competitive rates with no hidden fees.

No, you pay a small deposit (typically $20–$40), and the first month’s premium is deferred, increasing later monthly payments.

Carriers like Progressive, Kemper, and Farmers may provide this offer. Compare plans from top car insurance providers to find the best deal.

Drivers with DUIs or major violations may not qualify, but those with minor infractions might. Explore SR-22 insurance options for high-risk needs.

With Good to Go Insurance, you can secure instant car insurance in minutes, ensuring immediate legal coverage.

Yes, but requirements may vary. Check out insurance for leased cars for tailored options.

Don’t let budget constraints keep you uninsured. Get started with Good to Go Insurance today and drive confidently with affordable, reliable coverage!