Cheap Car Insurance For Women

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

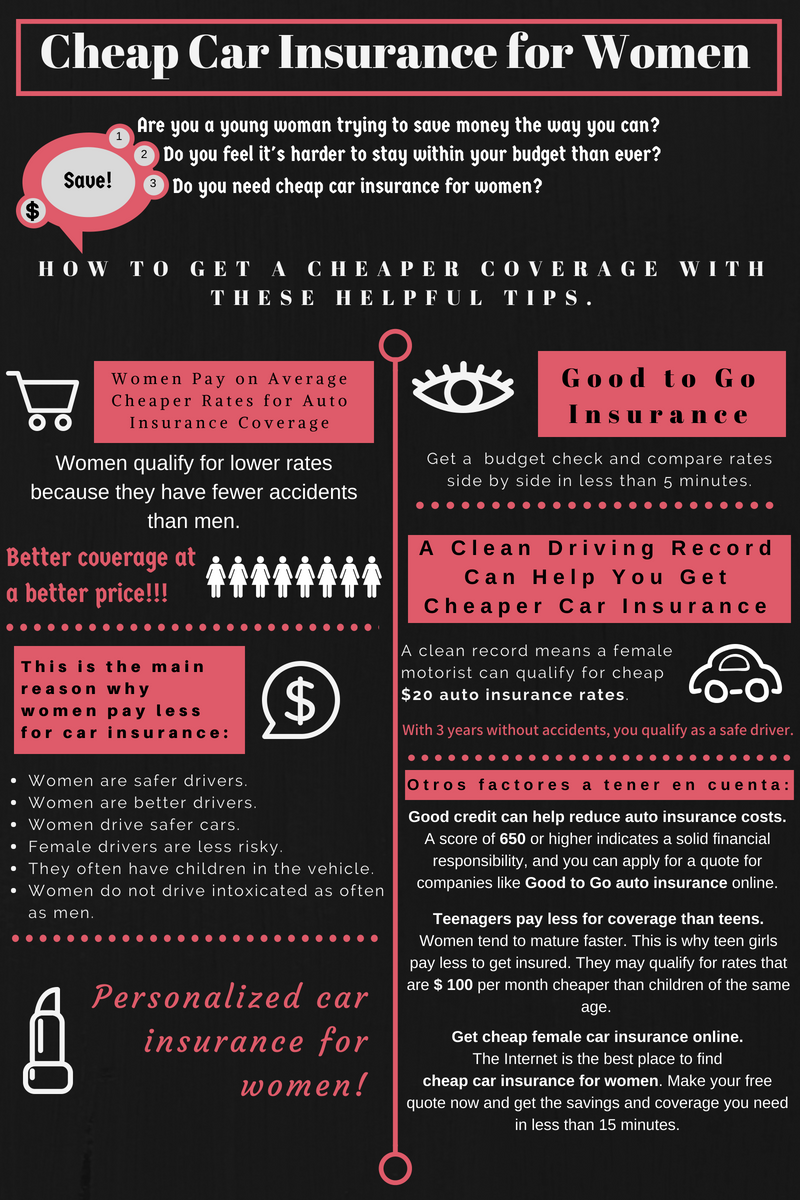

Are you a young female trying to save money any way you can? Does it feel like it’s more difficult to stay within your budget than ever before? If this sounds like you, then one way to save is getting cheap car insurance for women. If this creates a little skepticism, don’t worry. It’s really possible to get cheaper coverage with these helpful tips.

The truth is, women qualify for lower rates than men because the data shows they get into fewer accidents. This means with the right amount of research, better coverage can be purchased at a lower cost. Get a quote check up from Good to Go Insurance and compare rates side by side in less than 5 minutes. Here are the main reasons why females pay less for auto insurance.

Most female motorists have good driving records. The truth is they get fewer tickets than men. One of the main factors auto insurers use to calculate premiums is a person driving history, including accidents and tickets. A clean record means a female motorist can qualify for cheap $20 auto insurance rates.

If you’ve been accident-free for 3 years, you qualify as a safe driver with most carriers. There are other factors of course, but this is something you can control by being a safe, accident-free motorist.

Women tend to be more financially responsible than men. This means higher credit scores and better loan terms. Auto insurers these days give a lot of weight to a persons credit score. A score of 650 or higher indicates solid financial responsibility. A low score means a person is taking more risks. They are also under additional stress, which can affect driving behavior. Stats prove that motorists with lower credit ratings get into more wrecks. If you have a score under 650 get it cleaned up and apply for auto insurance quotes with companies like Good to Go auto insurance online.

Women tend to mature faster. Even as teenagers, they take the responsibility of driving seriously. They do not drag race as often nor speed, like many boys who are just getting their license. This is why teen girls pay less to get insured. They can often qualify for rates that are $100 per month cheaper than boys their same age. The key to getting the best deal is to shop around online and compare at least 10 quotes.

Women are smart shoppers. It’s no different for finding deals on auto insurance. More women today are turning to online quoting sites to find cheaper coverage. Not only can you save time by searching for direct auto insurance on the web, but most consumers can save $500 or more. The internet is the best place to find cheap car insurance for women. Get started now and apply for your free, no-obligation quote. Get the savings you need and also great coverage in under 15 minutes.