The Basics of Non-Owner Auto Insurance

If you currently drive an insured car that doesn’t belong to you, buying non-owner car insurance might be an option to consider. A non-owner auto insurance policy can save you significant money if you get into an accident in a vehicle you don’t own, including rental cars.

Do you find yourself using your friend’s or family member’s car a lot? Have you ever thought about what would happen if you got into a severe wreck that causes extensive medical costs and vehicular repairs? You can be held liable if you get into an at-fault accident that could cost you out-of-pocket money in the thousands if something goes wrong.

Your best bet is to get added coverage and protect yourself with a non-owners automobile policy. Get a quick quote in minutes and compare cheap non-owner rates in about five minutes.

To get going, just enter your zip code.

Non-Owner Insurance is Added Protection

Think of non-owner coverage as a backup plan if you use someone else’s automobile and get into a wreck. The owner’s policy is the primary insurance, while your non-owner policy serves as added protection. Even if you don’t own the car yourself, you still need to sign up for a viable plan to protect yourself if you were to get into an accident.

For example, you might borrow a family member or friend’s vehicle for a couple of weeks while your car is being repaired and never think about auto insurance and assume you are covered. That type of thinking can end up costing you big if you get into a wreck.

Car insurance policies are specifically designed to insure you for the times you drive someone else’s vehicle. This coverage is put in place for those without a car. If you are renting or borrowing a vehicle owned by someone else, you need the least state minimum liability insurance. Good to Go Insurance can explain your options and give you a hassle-free, no-obligation quote online or over the phone if you’re looking for more information. Apply now and find cheaper rates in less than 5 minutes.

Some Carriers Extend Coverage to Rental Vehicles

There are insurance providers that will extend non-owner coverage to rental cars. If you travel frequently and often use rentals, this is an essential item worth considering. While many credit card companies have rental car insurance programs, they might not have high enough limits to protect you adequately. You should also note that rental firms are required to maintain state minimums for liability insurance for all their vehicles. If you travel abroad for a short trip and rent a car, your non-owner car insurance policy might offer coverage to a specific country for an additional charge. Always check for the best rates before buying any non-owner coverage.

What Is Covered with a Non-Owner Policy?

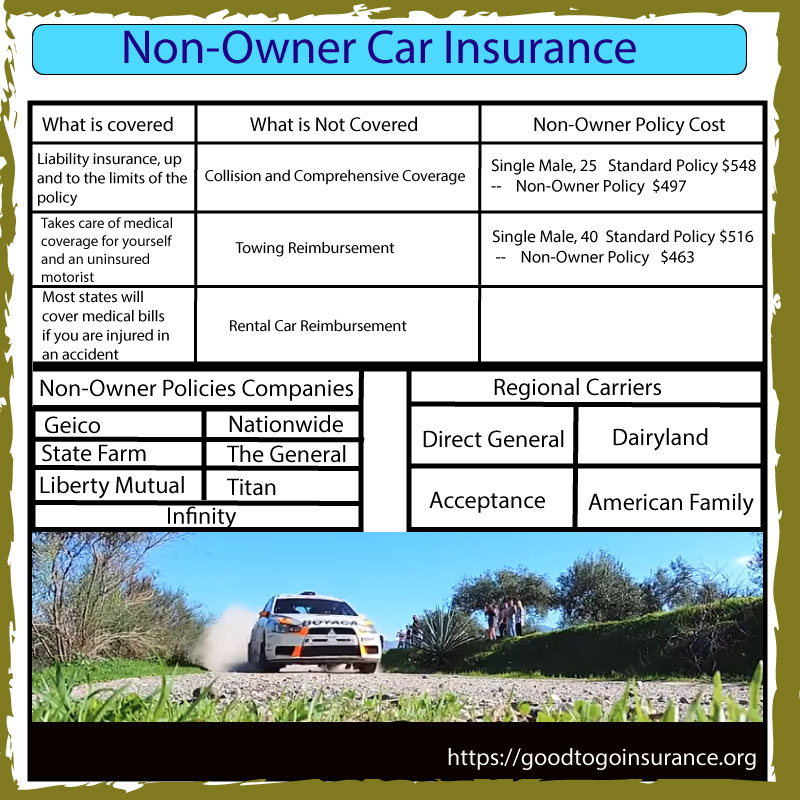

Non-owner coverage provides liability insurance up and to the limits of the policy. It also takes care of medical coverage for yourself and an uninsured motorist if you get into an accident, up to the policy’s limits.

While it can depend on the insurer in certain areas, most states will cover medical bills if you are injured in an accident caused by someone without enough insurance to pay for it. It’s essential to go through any policy carefully before you buy it so you know exactly what you are covered for.

What is Not Covered

- Collision and Comprehensive Coverage

- Towing Reimbursement

- Rental Car Reimbursement

How Much Does A Non-Owner Policy Cost?

A non-owner policy typically costs less than standard coverage, mainly because it covers less. A non-owner policy’s cost also depends on your age, location, vehicle type, how much you drive, your driving record’s current status, and other factors. Rates for good drivers start at about $39 per month.

You may be considered a high-risk driver if you have multiple violations on your DMV driving record, such as reckless driving. You can expect to pay much more for coverage in this situation, sometimes twice as much as safer motorists. Below are two examples of the cost of standard insurance vs. a non-owner policy.

| Age | Standard Policy | Non-Owner Policy |

|---|---|---|

| 25 | $548 | $497 |

| 40 | $516 | $463 |

When to Get Non-Owner Car Insurance

Some people who borrow cars may wonder whether getting non-owner car insurance is the right idea. Typically, you will want to consider getting this type of ins if you meet one or more of the following criteria:

- You have been convicted of a DUI or a severe violation in which your state requires you to fill out an SR-22 form. This is necessary to have your driver’s license reinstated. A non-owner ins policy can work well if you don’t own your car.

- You rent cars often and frequently. Whether you rent vehicles for work or travel, having your own non-owner car insurance can be cheaper than paying for liability insurance each time you rent a car. This insurance policy will pay if you cause property damage or injure someone in an accident. However, it will not pay for damages to the vehicle you’re driving when the accident occurs. Make sure to get a collision damage waiver from your rental car company the next time you rent one out.

- You often borrow a friend’s or family member’s automobile. Non-owner policies give you liability protection and can make you feel safer when you share your car. It will also protect you if an accident victim decides to sue you. If you get into a severe accident that’s your fault, this coverage can protect you from a financial disaster.

- You use Zipcar or other car-sharing services. If an accident’s cost exceeds the owner’s liabilities, you might have to shell out the remainder. A non-owner policy can get you off the hook when paying out-of-pocket costs.

- You are interested in maintaining auto insurance coverage even if you don’t have your automobile. Going without coverage can look risky on your profile and result in rate increases, and having continual insurance will mark you as a reliable, stable driver.

Remember that if you live at home with your parents and use one of their vehicles every day for work, you should not get non-owner car insurance. Instead, you should be added to your parent’s auto insurance plan as an additional driver.

Do Non Owner Policies Have Optional Coverage Options?

Unfortunately, non-owner policies do not have any optional coverage options. Most standard car insurance plans allow for additional coverage, such as collision and towing. You do have the option of selecting the limits on your policy, which should be set at an amount that protects your assets.

Which Insurance Companies Offer Non-Owner Policies?

Shopping around for the best auto insurance is a simple process, thanks to the internet. Currently, seven companies offer non-owner car insurance policies across the nation:

- Geico

- State Farm

- Farmers

- Allstate

- Acceptance

- Liberty Mutual

- Nationwide

- The General

- Titan

- Infinity

- Travelers

Each of these providers offers plans nationwide. If you already have a policy with one of these insurers, you can often save money when adding non-owner auto insurance.

Regional Carriers that offer Non-Owners Coverage

Here are some regional carriers that offer non-owner liability policies:

- Direct General

- Dairyland

- Acceptance

- American Family

Buying Cheap Non-Owner Car Insurance Online

While many major companies offer non-owner auto insurance coverage, it isn’t the most popular and promoted product. Most people don’t even know that this kind of liability coverage is an option.

In reality, this insurance policy is an excellent alternative if you can’t get full coverage. While you may not be able to get a direct quote online through one of the company’s websites, you can easily get cheap non-owner coverage with Good To Go Insurance.

This type of insurance will give you peace of mind and save you money if you ever get into a significant crash using another person’s car. Start your free quote now and explore all your insurance options. Enter your zip code and start comparing the cheapest non-owner insurance quotes in about five minutes.