Chubb Auto Insurance Review

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

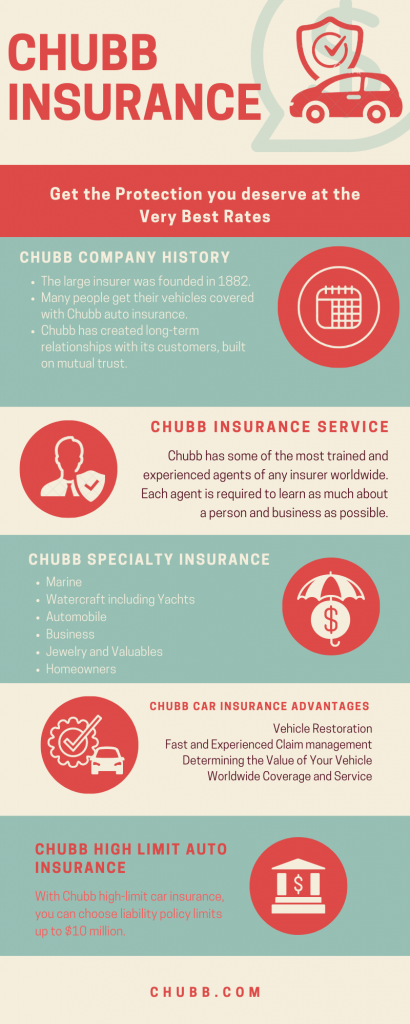

Founded in 1882, Chubb is one of the oldest and most respected insurers in the U.S., renowned for its premium auto insurance tailored to high-end and classic vehicles. While Chubb started as a marine underwriter, it has grown into a global leader in property and casualty insurance, offering specialized coverage like the Chubb Masterpiece car insurance. At Good to Go Insurance, we help you compare Chubb’s offerings with other providers to find the best rates for your needs.

Chubb was established by Thomas Chubb and his son Percy in New York City with just $1,000, focusing on marine vessel and cargo insurance. Their expertise in risk assessment and strong agent-client relationships fueled rapid growth. By the early 1900s, Chubb was a prominent player, reinvesting profits to expand its offerings. Today, nearly 140 years later, Chubb remains a leader in marine underwriting and has diversified into auto, homeowners, and specialty insurance, serving clients worldwide.

Chubb’s auto insurance is designed for luxury and classic car owners, offering customizable coverage through its Masterpiece policy. Key features include:

Chubb provides 24/7 support in 54 countries, ensuring assistance even when renting vehicles abroad. This global reach makes Chubb a top choice for affluent clients with international lifestyles.

Chubb stands out for its customer-centric approach and premium services. Here’s why clients choose Chubb:

Chubb’s stellar claim payout record and high customer satisfaction make it a preferred choice for renewing policyholders. Learn more about car insurance settlements to understand the claims process.

Beyond auto insurance, Chubb offers a range of specialty products:

Bundle auto and home insurance for discounted rates, maximizing value.

Chubb boasts top-tier financial ratings, ensuring reliability:

These ratings reflect Chubb’s ability to meet claims obligations, giving policyholders peace of mind.

Chubb’s website and mobile app offer 24/7 access to policy details, bill payments, and claim updates. The app also provides instant roadside assistance and live chat with representatives, showcasing Chubb’s commitment to innovation. For personalized quotes, contact a Chubb agent or compare Chubb’s offerings with other providers through Good to Go Insurance.

While Chubb excels in premium auto coverage, it may not suit budget-conscious drivers. Use Good to Go Insurance to compare up to 10 quotes in 5 minutes, including options like no-down-payment insurance or liability-only policies. Enter your zip code to find the best rates tailored to your vehicle and budget.

Chubb offers agreed value coverage, OEM parts for repairs, and high-limit liability up to $10 million, ideal for luxury and classic car owners.

Chubb targets high-end vehicles, so premiums may be higher. Compare rates with affordable car insurance options to find budget-friendly alternatives.

Yes, Chubb provides up to $15,000 in rental car reimbursement, matching your vehicle’s quality, with worldwide coverage for rentals.

Yes, bundling auto and homeowners insurance with Chubb’s Masterpiece policies can unlock discounts. Explore insurance discounts for more savings.

Ready to protect your vehicle? Compare Chubb and other top providers with a free quote from Good to Go Insurance and secure premium coverage today!