$20 Down Payment Car Insurance

There are those of us that are on a tight budget and then there are people who have a super tight monthly budget. That means getting good and services for as cheap as possible like auto coverage. Some consumers can only afford $20 down payment car insurance and others need to get an even cheaper plan.

Most insurers will demand that you pay part of the premium upfront before the policy becomes active. The problem is, some cash-strapped people can’t afford $90 or even a $50 down payment. This includes students, those recently laid off from work and also temporary conditions, like someone who just used up their last dollar to buy a car. Whatever the scenario is, a super cheap auto insurance down payment is needed.

Auto Insurance Payment Options

Carriers will offer installment programs, that go along with your down payment, which may be nothing down or a very cheap car insurance no deposit. The payment terms are set up with several options, including:

* Payments made every 6 months (for a 12-month policy)

* Payments made Quarterly (these are offered on both 6 and 12-month policies)

* Monthly payments on most policies

When a person decides to pay for their coverage through an installment plan, they usually need to put down a deposit to get the policy going. Normally, the first month’s payment is what most insurers use. There are also numerous ways you can pay your bill. One of the benefits to getting a direct policy is you can make your payment online. Here are a few of the most common payment methods:

* Pay by Check

* Money order

* Electronic Funds Transfer

* Credit or Debit Card

* Paypal

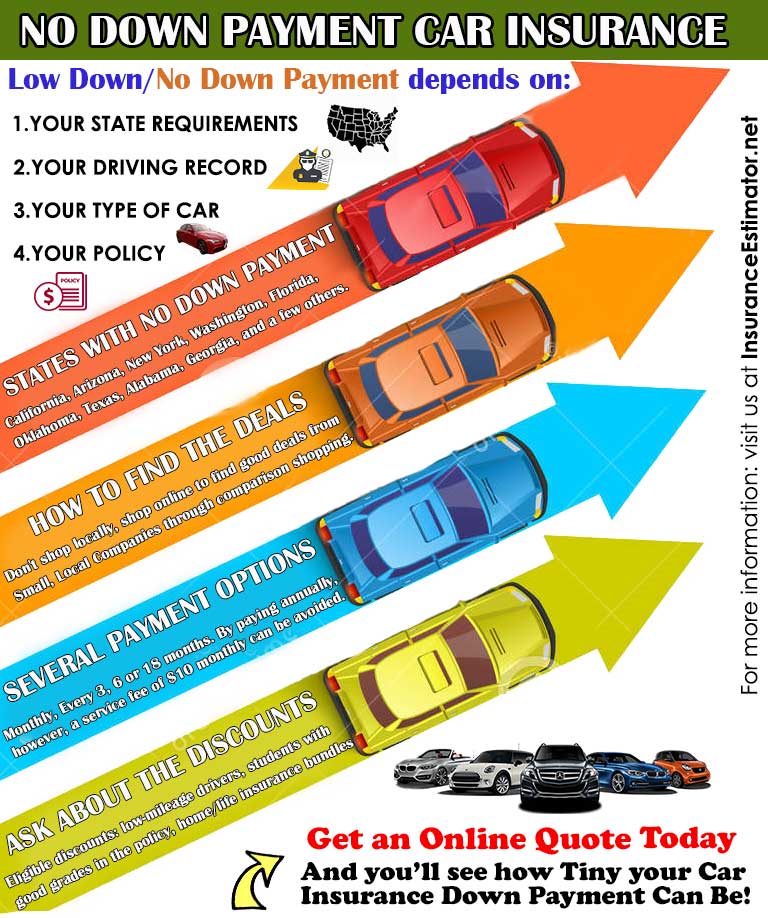

There is a solution for those consumers that can’t afford to make any payment but still need to get their vehicle insured. The first thing you need to do is look for auto insurance carriers that specialize in no money down coverage or have a very low requirement, like $20. Now, this is where it gets a little bit tricky. Whether you qualify for $20 down payment auto insurance will depend on a few things.

The first of which will be the make, model, year, and type of car you plan on getting insured. For example, you probably can’t call up an ins provider and try to get a Corvette sports car covered with nothing down. This isn’t realistic because the insurer knows there is a higher chance of a “high performance” automobile getting into a wreck and causing serious damage and injuries. However, if you have a used Toyota Corolla that you only drive 400 miles per month, then you have a shot. Also, if your vehicle is new and costly, then there is less of a chance you are going to be able to get a policy with nothing down. When you buy auto ins, the provider is taking a risk and betting that you won’t get into a wreck. This includes calculating many factors of risk, like repair and replacement costs. If you have a new BMW that costs $60,000, then you probably won’t need anything down car insurance and that’s a good thing because it is not likely you could find it.

Getting the cheapest car insurance down payment requires being less of a risk to the companies. Customers from Georgia (GA) looking for cheap car insurance can check out this link: cheap car insurance in ga with low down payment. The less likely you are to get into an accident then the more willing an insurer will be to offer incentives on the policy. Another factor that comes into play is credit. These days auto insurance firms are placing a higher degree of weight on a person’s credit rating. The theory goes that someone who is responsible with their money should also be a responsible driver. So in order to qualify for new $20 policies, you need to make sure your credit is in good standing. If it is not, then take aggressive steps to get it fixed. It will not only help you with cheaper car insurance but so many other things.

The Pros and Cons of Getting Car Insurance With No Down Payment

Another important thing you need to consider is these low-down policies are often more expensive over the course of the year. For example, you might think you are getting a great deal on a policy that requires nothing down. Then, you’ll be paying $150 a month for the next 11 months, totaling out to $1,650. Another insurer might require you to pay $200 down for the first month, but then the remaining 11 months, the premiums are just $110. This policy would total out to $1,410 and be $240 cheaper annually than the no-down one. Of course, you probably need the no down policy, so you are willing to pay a little more on the back-end because you really need very cheap car insurance no deposit because you are temporarily cash-strapped.

You will also have a much greater chance of getting no down vehicle coverage if you get a liability-only policy. Getting the state minimum coverage can be purchased for as little as $29 monthly, with nothing down, depending on the state you live in and the insurer. Liability insurance is mandatory, so you have to have it. It is also a starting point for insuring your car and comes with limited coverage. These “bare bones” types of policies can cause more harm than good if you get into a serious accident.

Get the Cheapest Auto Insurance Plans Online

If you need auto insurance with no payment up front, then you need to invest a little time researching. The best place to look for these deals is online. Some of the lowest rates and special offers are found on the web. This means you might not even be able to find some of the special promotions by calling up an insurance agent. To get started, just go to leading sites that offer direct rates like good to go insurance. You can compare up to 10 plans and it is totally free. You can also call a representative toll-free if you have any questions. Start your quote now and get the $20 down payment car insurance you need today.

$20 Dollars Down

Get and Compare the Best $20 Down Payment Car Insurance Quotes Online. We have been helping consumers save money on car and home insurance for decades. Our customers save on average $550 and often get better coverage. See the Good To Go Insurance advantage for yourself today.

Get a free online quote now and see how easy it is to save.

Testimonials

This is What Our Clients Say!

”Good To Go Insurance makes saving money on car insurance so fast and easy..”

“The no money down payment option really helped me out a lot. The rates are also the cheapest I've ever had.”

Press Release

Good To Go Insurance Company to Sell and Underwrite Direct Auto Insurance Policies ...

Good Discounts

At Good To Go Insurance, our goal is to save our valued customers as much as possible on auto and home insurance. Check out our site for a full list of driver discounts that will save you even more!