Buying Auto Insurance for a New Car

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

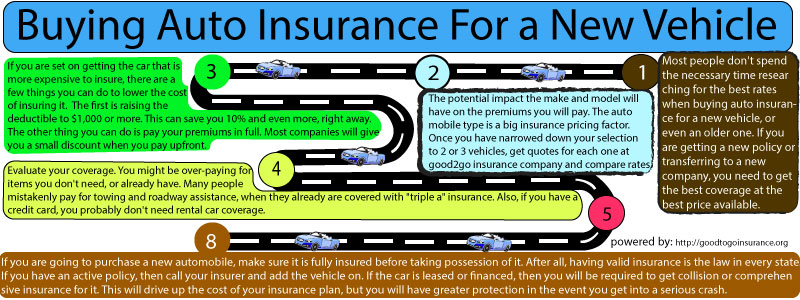

There are so many decisions you need to make when looking for a new car. Do you go with a SUV, a sedan, 2 doors or 4? With so many quality brands and styles to choose from, some people take months to figure out what automobile they want to get. Once you have selected your car and have made the purchase, there are a few other things to get, not the least of which is auto insurance coverage. Most people don’t spend the necessary time researching for the best rates when buying auto insurance for a new vehicle, or even an older one. If you are getting a new policy or transferring to a new company, you need to get the best coverage at the best price available. Compare direct rates online in only 5 minutes or less with a quote from good to go insurance online.

Comparison Shop the Best Quotes Before You Buy a Policy

One of the important things to consider when you are shopping around for a car is the potential impact the make and model will have on the premiums you will pay. The automobile type is a big insurance pricing factor. Once you have narrowed down your selection to 2 or 3 vehicles, get quotes for each one at goodtogo insurance company and compare rates. If they are almost all the same, then it should not play too much into your decision. However, if you are on a tight budget and one or two cars cost $50 more per month to insure, then this should play a big role in what you buy.

If you are set on getting the car that is more expensive to insure, there are a few things you can do to lower the cost of insuring it. The first is raising the deductible to $1,000 or more. This can save you 10% and even more, right away. The other thing you can do is pay your premiums in full. Most companies will give you a small discount when you pay upfront.

Another important step to lower rates is to evaluate your coverage. You might be over-paying for items you don’t need, or already have. Many people mistakenly pay for towing and roadway assistance, when they already are covered with “triple a” insurance. Also, if you have a credit card, you probably don’t need rental car coverage. Yes, it is boring to read through all your policies fine print, but it should only take a few minutes. Take notes on what items you can cancel and the limits you need. Next, go out and get quotes with direct insurers like good to go on-line.

Remember, there’s a good chance your current carrier may not have the lowest prices for the policy you need. Do not be afraid to switch to a different provider. There are friendly phone representatives that will gladly help you change over and get you a full refund for any outstanding balance on file. There is also a good chance you will get enhanced coverage for a lower price. Comparing quotes has so many advantages and no risks. Keep in mind; you are never under any obligation to buy a policy.

Check Rates for Your New Car Every 6 Months

Once you have bought a new policy, don’t stop checking rates periodically. There are always great insurance deals that pop up, and you need to be ready to pounce on them. A good rule of thumb is to get car insurance quotes for your new vehicle every 6 months. There’s no excuse because, at sites like good to go auto insurance, the entire quote process only takes about 4 or 5 minutes. Think about it; you can get a quotation on your smartphone in the bathroom in no time at all.

If this sounds like another boring task to take care of, just think about the money you could save. In less than an hour, you could compare policies, buy a new one that saves you $300 and cancel your old policy. You probably are not making $300 an hour, so this is time well spent.

Get Covered Before Driving Your New Car off the Dealer’s Lot

If you are going to purchase a new automobile, make sure it is fully insured before taking possession of it. After all, having valid insurance is the law in every state. If you have an active policy, then call your insurer and add the vehicle on. If the car is leased or financed, then you will be required to get collision or comprehensive insurance for it. This will drive up the cost of your insurance plan, but you will have greater protection in the event you get into a serious crash. You should also read the declarations page and see if your current ins policy will cover your car for a limited time. If you are confused about your declaration page and whether your new auto will be covered for a short time, then pick up the phone and call a company representative. It never hurts to just ask.

Now that you know how important buying auto insurance for a new vehicle is, apply for a free quote today. With direct rates and instant online discounts, you can save hundreds. Get started now and lower your premiums for your new car.