Good to Go for the Cheapest Car Insurance in Michigan

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

Michigan is the modern car’s birthplace and is home to Chevrolet, Ford, and Dodge motors. Residents love their cars so much; Detroit is nicknamed the Motor City. This state has a population of almost 10 million and has just about the same amount of vehicles. All of those cars need to be insured to meet the state insurance laws. With the current challenging economic situation the state has been enduring the last few years, consumers might wonder, who has the cheapest car insurance in Michigan?

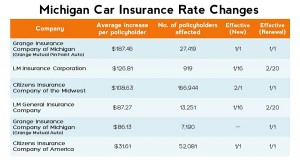

The average private-sector wage is about $49,000 annually, which is near $5,000 below the national US average. Despite the area’s lower-income, auto insurance rates have steadily climbed and now have some of the country’s highest costs. A recent consumer study surveyed quotes from all the major automobile insurers in Mi. For almost every category, from senior driver to teen, Hastings insurance had the best rates.

There was a wide gap in pricing, with some companies like State Farm charging more than triple for monthly Michigan auto insurance over Hastings Mutual. While this midsize insurer is not as well known as their larger competitors like Farmers and Allstate, their premiums will save most drivers about $1,000 yearly. Compare up to 10 insurance quotes in MI with a quick quote from good to go insurance.

Residents in Michigan, who operate a motor vehicle, are required to buy the minimum amount of vehicle coverage mandated by state officials. The no-fault liability minimums are:

When shopping for MI ins, remember that these state minimums are just that, and you might need additional coverage to be adequately insured. A sound policy should be designed to protect your physical well-being, property, and assets in the case you are sued for a substantial amount. In short, you should consider securing insurance protection that covers most, if not all of your assets and even legal representation.

Drivers must also keep their MI insurance ID cards in their vehicles at all times. If an officer pulls over a motorist who does not have proof of insurance, their license can be suspended, a fine imposed, and the vehicle may be towed. A judge can also mandate six months of pre-paid insurance for those caught driving uninsured and wish to reinstate their drivers’ license. Considering the high cost of uninsured penalties, it only makes sense to get covered before driving. Get a rate checks up with go auto insurance today and save $500 or more online.

There is a big problem in Michigan with insurance fraud. This problem amounts to tens of millions of dollars each year and raises the cost of ins for everyone. Some of the more common fraudulent incidents that occur are fake accidents that are staged and reported stolen vehicles that are, in fact, hidden away. Other people lie about where they live to get lower rates. Insurers have special programs in place to fight this ongoing crime, but with a weak economy, criminals are attempting this type of fraud in larger numbers.

The best-selling vehicle recently in the state is not a foreigner plate or truck. According to Kelly Blue Book, the Ford Fusion is the best-selling automobile in Michigan. This is because the car combines both high performance, good gas mileage, and a modest price tag. Other popular choices are the Ford F150 truck and the Chevy Malibu.

Michigan’s economy is in a renaissance period. Chevrolet and Ford are breaking sales records, and new technology firms like Quicken are investing heavily in the area. This economic insurgency has increased the once before week housing market. While home prices in Michigan are still low compared to California and other regions, they have been steadily growing since 2010. One consumer must-have, car insurance coverage, has risen higher than other states due to increased fraud, theft, and accidents.

There are still some great chances to be had for the smart shopper, however. The best way to find the cheapest car insurance in Michigan is to go online. With good to go insurance, you can compare all the top car insurers in less than 10 minutes. Get started now and enter your zip code and fill out the secure online application.