What Exactly is PIP Auto Insurance?

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

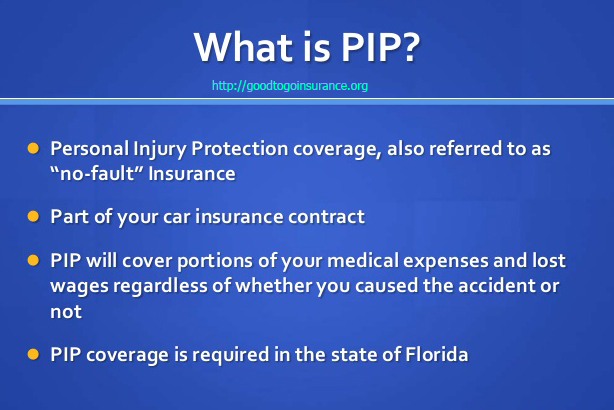

Have you ever heard an insurance agent talk about coverage, including all the different options, and you feel totally confused? They throw out so many terms like gap coverage and extended limits; it feels like there is some coded language going on. For those that are not experts, you might be wondering what exactly is PIP auto insurance. This type of automobile coverage stands for personal injury protection. This added insurance will pay for certain hospital costs after a vehicle accident in addition to non-incident-related charges. One of the main benefits this policy gives is compensation for lost wages after severe bodily injuries occur.

A PIP claim will become activated regardless of what party was responsible for the crash and is often referred to by industry experts as “no-fault” protection. Get your free “P-I-P” car insurance quote online in less than 5 minutes with good to go. Comparison shop from up to 10 national carriers and select the plan that works best for you.

Have you ever considered how expensive medical costs are and the fact they are rising every year? One of the most costly aspects of an automobile accident is the medical bills. If you do not have the proper amount of insurance, you will be billed for any amount of healthcare costs after an incident that your insurer does not cover. This coverage can include ambulance, physical therapy, and other healthcare expenditures.

Adding PIP insurance to your policy will cover most, if not all, of these bills. Most policies will even cover upkeep to your home, like yard care and cleaning. Although this type of policy is more costly than the others, it will pay for itself in the unfortunate event you ever get into a severe crash. Get quoted now and find the cheaper car insurance in your area.

There are now thirteen states in the country that mandate this coverage. They include Florida, Utah, North Dakota, Hawaii, Kansas, Massachusetts, New Jersey, Pennsylvania, Minnesota, Michigan, Massachusetts, and the Washington D.C. area. Considering how healthcare expenses are rising so much, more states might make this type of added protection mandatory shortly.

It is important to note that not every state currently has PIP plans available, but most do. Big populated states like California and Texas do not require it but offer this protection for drivers. Get your Good to Go Insurance quote online or over the phone today.

Every state is responsible for making its insurance laws and regulations. Insurers, however, have leniency to offer certain coverages within those guidelines. With PIP protection, many states have varying degrees of acceptable procedures that are covered. For example, massage therapy might be ok in Florida but not in Minnesota. Check with your insurance agent if you are confused about what treatment your policy will cover.

One of PIP plans’ main benefits over “Med Pay” and other assurances is it covers both the expenses related to the crash and compensates for lost income. Many costs are non-related to an accident that most people never even think about until such an event happens. Thus, these plans are more comprehensive in nature and provide a wider array of benefits.

In the past couple of decades, states have been bogged down with high rates of personal injury auto accident cases. This fact has resulted in more states passing “no-fault” initiatives and mandatory PIP insurance to keep court lawsuits to a minimum. Although these laws have reduced court activity and frivolous lawsuits, some experts believe many victims do not get their rightful day in court or adequate compensation due to injuries from an at-fault incident. The great thing about states that mandate PIP coverage is it speeds up accident claims, and people get their compensation faster.

Now that you are familiar with PIP auto insurance, get a fast quote online and see how competitive your rates can be. With good to go insurance, the average customer saves over $500, and you can even buy a policy online. Get started now and lower your auto insurance bill.