First Month Free Car Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-620-9443

Company Trusted For Over 25+ Years*

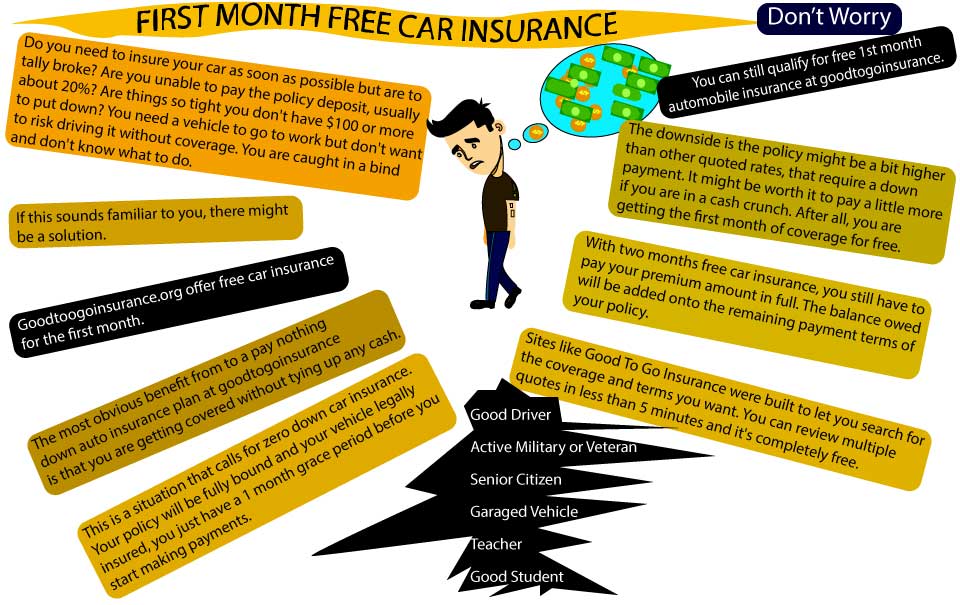

Are you short on cash and need first month free car insurance? You might ask, is first month free car insurance even available, and how do I get it? Many people need to get their car insured as soon as possible, but currently just don’t have a lot of money. They can’t even make the first month’s installment payment.

Perhaps this is the situation you are in right now? Certain auto insurers will waive the first monthly payment and defer the amount owed towards future policy payments. While you are getting a free month of auto insurance, you still need to make a deposit payment. You will then pay the entire premium in the remaining months of the policy.

What is First Month Free Car Insurance?

This type of auto insurance policy is similar to any other six or twelve-month policy. You’re just paying less upfront. Even though you are getting free first month car insurance, you still need to make a deposit payment. Then you will be required to pay for the total premium amount in the remaining payments.

To illustrate this, let’s say you had a liability-only policy for $760 per year. You qualified for the first month free auto insurance, with a deposit of only $40. So, for the first month of coverage, your only out-of-pocket cost is $40. The remaining $720 owed will be made in eleven installment payments of $65.45 and not twelve payments.

As you can see, you are just adding a higher payment amount to the remaining 11 monthly installment payments from now on. You are not saving any money but deferring the amount owed.

The most obvious benefit to a pay nothing down auto insurance plan is that you are getting covered without tying up a lot of cash. This plan is a good option for those temporarily cash-strapped but still need to get their vehicle insured right away. You can qualify for your first month’s car insurance with complete coverage. Your policy will not change in the second month or the remaining months thereafter.

There is just no such thing as free car insurance, as you must make a payment before your policy goes into effect. No insurance company will cover a motorist for free. To put it simply, you cannot legally get insured for one day or one month without first making a payment to the insurer. If an insurance company or agent is promising that there’s no payment required for car insurance coverage, then it’s entirely false advertising.

Many smaller carriers use aggressive promotional advertising to lure new customers with free car insurance promises for two months. Others advertise car insurance first month free no deposit and zero down car insurance. These companies, for the most part, are not trustworthy.

Think about it this way. Let’s say you did get free auto insurance for two months and then went out the first week and got into an expensive at-fault accident that resulted in $30,000 in damages. The insurer would then need to make a huge payout without ever receiving a penny from you. No carrier does business like that. Again, you need to make an initial payment to get legally insured.

With millions of consumers searching for the cheapest car insurance online, insurers have to stand out in the pack. This means offering deep discounts that bring in new customers. A few carriers have begun to offer even deeper discounts, including the first two months of car insurance for free.

This is a huge incentive that can get you on the road for an entire two months with very little money down. It is excellent for people that can’t afford a costly insurance payment upfront but need to get covered right away. This can apply to people starting a new job, like an Uber driver, who need their vehicle to make money.

With two months of free car insurance, you still have to pay your premium amount in full. The balance owed will be added to the remaining payment terms of your policy. This type of deal is typically given to current customers who have at least one year of continuous coverage but need to renew soon. Insurers, in “good faith,” provide these incentives to keep quality customers renewing their policies.

The short answer to this is no. This type of policy will likely be more expensive. It’s riskier to the carrier because they are getting a lower upfront payment. Insurers do not widely promote these discounted policies. With the first month free auto insurance, there is a greater chance the policy will be canceled. Other risks come with these types of discounted policies, such as fraud and bogus claims.

Providers usually require large deposits, often 20% to 30% of the total premium. The more considerable your deposit amount, the less you will pay in monthly installments. Compare top-rated insurers’ best rates now by entering your zip code.

There are numerous reasons why someone needs the cheapest auto insurance with the lowest deposit. Auto insurance is mandatory by law. If you operate a motorized vehicle, it needs to be insured, regardless of your personal financial situation. Never drive without legal car insurance. It’s just not worth it. With discounts like low down payments from $20, there is no excuse to drive uninsured.

Drivers that are so cash-strapped they can’t make their first auto insurance payment can benefit from the first month free car insurance. Other everyday situations are:

This type of policy makes sense for someone in a short-term cash bind, for example, a person who has just bought a new car and used their entire savings for the down payment, sales tax, and registration fees. Sometimes, there’s just not much left over for automobile insurance.

This situation requires the cheapest out-of-pocket policy possible. Your coverage will be fully bound, and your vehicle legally insured. However, you just have a 1-month grace period before you start making monthly payments.

This type of policy can get you covered until things improve for you financially the next month. With competition for new customers intense, especially online, insurers are resorting to deep discounts to bring in new business. With the average insurance rates on the rise, these deeply discounted policies can be a big boost for those struggling to make their budget work.

Carriers offer these discounts to current policyholders and new customers. However, not everyone will qualify. To increase your chances of getting this type of deal, you should:

If you have multiple tickets and accidents on your record, you will not qualify for this discount. Also, high-risk drivers with a DUI on their record or other flagrant vehicular violations will not be eligible. In short, the less of a risk you are to the insurance company, the more likely you will get auto insurance with the first month free.

On the other hand, if your driving record has some minor blemishes on it, you can still qualify for car insurance first month free. The downside is the policy might be a bit higher than other quoted rates, which require a large down payment. It might be worth it to pay a little more for coverage if you are in a short-term cash crunch. After all, you are getting the first month of coverage for free.

Most insurers offer a discount of 2% or more if you pay for the policy in full up-front. This can save you a little bit, which makes sense for those who can afford it. However, if you are super low on money, it might make more sense to pay for the policy by making monthly payments and keep as much money as you can in the bank.

Thanks to the internet, almost anyone can get online and search for the type of insurance coverage and rates they need. If you’re in a money crunch and need a zero down policy, then do your diligence first. Many people go on the web and only get quotes from the most prominent TV advertisers like State Farm or Nationwide. These companies don’t always have the lowest rates. They might not even offer 1st-month free car insurance coverage either.

Every insurer does not offer this type of policy. Companies that do offer it include:

Many consumers who shop online for car insurance report saving $500 or more. Today, some of the lowest prices for auto insurance are found online with direct rates.

The next tip on getting cheaper coverage is to get all the discounts you qualify for. This can lower your premiums by hundreds annually. Some discounts offered are:

Now that you see the benefits of getting the first month free car insurance, it’s time to compare top providers’ rates and coverage. Simply fill out a free online application in about five minutes. You will then be matched with up to ten providers’ lowest rates. Get started now by entering your zip code and get covered for less today.